Disclaimer: This publish is meant to tell you of the overall particulars and finest practices for submitting 1099 varieties in property administration. For essentially the most particular and correct recommendation, all the time seek the advice of an authorized tax skilled.

Featured Provide

Begin your free trial at the moment!

Strive Buildium at no cost for 14 days. No bank card wanted.

Begin Your Trial

Property managers are going to be busy in 2026. In line with our 2025 Property Administration Trade Report, 75% of property managers we surveyed plan to develop their portfolios within the subsequent 12 months. Given the present financial local weather, they’re trying to try this by discovering artistic, tech-led options to streamline their companies whereas looking for out new shoppers.

With a lot on the horizon for property managers, property administration tax reporting, could also be the very last thing on their minds. Nevertheless it’s nonetheless a vital a part of 2026 planning.

That’s why we’ve created a information (and a video) to assist make the 1099 submitting course of as clean as attainable. To assist put your tax plan into motion, we sat down with Charlie Walsh, Buyer Advertising Supervisor at Buildium, to get his recommendation from years of expertise serving to property managers navigate their tax submitting challenges with purpose-built software program.

Who Must File 1099s in Property Administration

Property managers should file 1099 varieties after they pay $600 or extra yearly to particular person contractors or unincorporated companies, because the IRS doesn’t require returns for funds lower than $600 in a tax 12 months. This contains funds in your personal enterprise operations and work completed for property homeowners you handle. The 1099 varieties report these funds to the IRS.

Necessary be aware: The $600 minimal can be raised to $2,000 for the 2026 tax 12 months.

What Are 1099-MISC and W-9 Varieties?

The IRS makes use of the 1099-MISC to report a wide range of earnings obtained that isn’t reported on commonplace W2 varieties. Whereas non-employee compensation is now filed below the 1099-NEC (we’ll get to that later), you’ll nonetheless must file a 1099-MISC for:

- Hire earnings

- Prizes and awards

- Money paid from a notional principal contract to a person, partnership, or property

- Fishing boat proceeds

- Medical and well being care funds

- Crop insurance coverage proceeds

- Funds to an lawyer

- Part 409A deferrals

- Non-qualified deferred compensation

- Different earnings funds

For property administration tax submitting, that implies that 1099-MISC varieties are the first technique to report:

- Hire offered to an proprietor from a leased property totaling $600 or extra

- Lawyer charges totaling $600 or extra

Every time a property supervisor brings on a brand new proprietor or regulation agency, they need to request a W-9 type. The W-9 gives you their submitting standing and federal tax ID, so you possibly can file your 1099-MISC varieties precisely when the time comes.

Property managers are required to request a W-9 type and problem a 1099-MISC type to every proprietor, lawyer, and contractor they work with, as long as funds meet or exceed the $600 threshold. The IRS makes (sometimes small) changes to the 1099-MISC type annually.

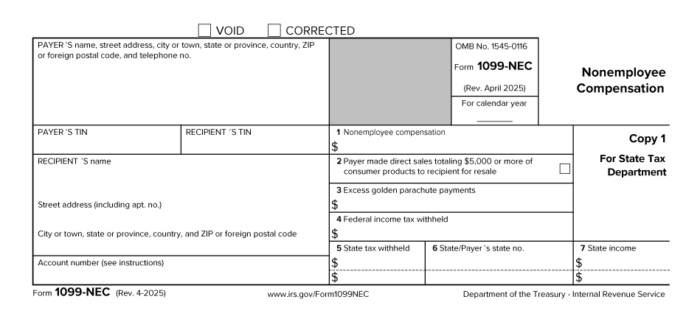

For 2025, the shape seems to be like this:

What Is a 1099-NEC Kind?

In 2020, the IRS started requiring companies to report non-employee compensation in a separate type, the 1099-NEC; beforehand, payers used Kind 1099-MISC for this goal. Right here’s how they differ:

We’ve created an in depth breakdown of the shape and what it means for property managers right here.

Property managers should file a 1099-NEC after they pay an unincorporated impartial contractor $600 or extra in a 12 months for work completed on a rental property proprietor’s behalf or instantly for the supervisor’s personal enterprise. You’ll must ship a 1099-NEC as a substitute of a 1099-MISC for those who made a cost:

- Of no less than $600 to a person or group through the 12 months

- To anybody who isn’t an worker (this may be a person, a partnership, an property or, in some circumstances, a company)

- For companies offered as a part of your online business (together with to authorities companies and nonprofit organizations)

For property managers, these standards sometimes boil all the way down to funds made to:

- Upkeep suppliers reminiscent of landscapers, plumbers, and HVAC professionals

- Service suppliers reminiscent of locksmiths, laundry and dry cleansing, or health instructors

It’s all the time a beneficial apply to seek the advice of a tax skilled for those who’re uncertain whether or not a selected cost falls into the precise class for a 1099-NEC. To offer you an thought of what to anticipate, the shape for 2025 seems to be like this:

1099 Exemptions for Property Managers

There are just a few situations during which property managers are exempt from submitting a 1099. As talked about earlier, 1099s aren’t required for any funds lower than $600.

If the rental property proprietor is established as a company, you don’t want to file a 1099-MISC type for funds made to that firm. You’ll nonetheless must file a 1099-MISC if the property proprietor is a restricted legal responsibility firm, or LLC, nevertheless.

You additionally don’t must file a 1099-NEC type for any upkeep work or different companies completed by an included enterprise. Once more, this exemption doesn’t apply to LLCs.

1099 Necessities for Property Homeowners

For those who personal the property you might be managing (a non-public landlord), you don’t want to file a 1099 for any work associated to that property. This has been the case because the reporting necessities inside the Inexpensive Care Act and Small Enterprise Jobs Act had been repealed in 2011.

When figuring out if a sure cost must be reported on a 1099, it’s all the time a good suggestion to fulfill with a tax skilled to be sure to are submitting accurately and to keep away from any penalties.

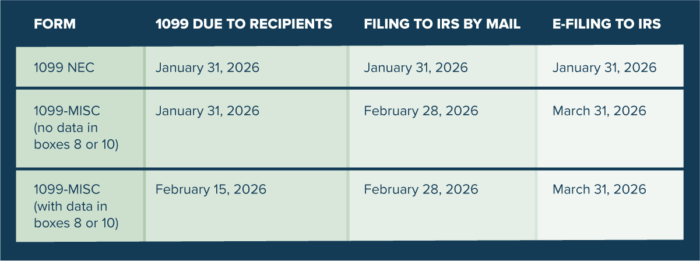

Deadline for 1099 Varieties

The submitting deadlines for 1099-MISC and 1099-NEC varieties rely upon the way you’re submitting and what info you’re offering within the varieties. Check out the desk under to find out when it is best to file:

All of your 1099 varieties should be submitted collectively, together with one copy of Kind 1096, the IRS equal of a canopy letter. You may receive an authentic Kind 1096, 1099 varieties and every other official tax paperwork (photocopies gained’t work) from the IRS instantly by way of their web site.

1099-MISC and 1099-NEC Submitting Choices for Property Managers

You may have a number of choices when submitting 1099 varieties. You are able to do it your self, both by mailing the paperwork in individual or electronically by way of the IRS’s Submitting Data Returns Electronically (FIRE) system or you possibly can rent an accountant or a CPA to do it for you.

It’s nearly all the time simpler, nevertheless, to file 1099s electronically (eFile) and the IRS requires you to take action for those who’re submitting 10 or extra 1099-MISC varieties.

It’s additionally a superb apply (and beneficial by the IRS) to maintain copies of your 1099-MISC and 1099-NEC varieties for no less than 3 years (4 years if backup withholding was imposed).

eFiling by way of property administration software program could make every step of the method simpler, permitting you to fill out 1099s in minutes and get them postmarked the identical day. This not solely quickens the method for property managers, but additionally reduces the effort and time distributors, homeowners, and different companions need to spend.

“Typically, property managers battle with understanding who to file 1099s for and for a way a lot,” says Walsh. “That’s the place the precise software program turns out to be useful. It routinely calculates how a lot an proprietor or vendor has been paid all year long, and brings them up if you begin submitting.”

File Create and Ship 1099s in Buildium

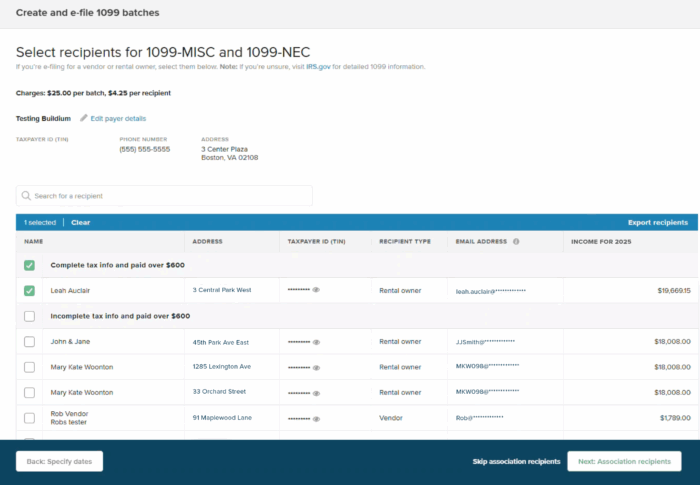

Utilizing current, purpose-built software program is usually the quickest and most cost-effective approach to go. By means of Buildium’s property administration software program, you possibly can generate and ship 1099s, together with each the 1099-MISC and 1099-NEC, to your entire homeowners, distributors, and contractors. Buildium additionally permits you to begin the method an entire month sooner than when submitting formally opens with the IRS, so you will get a leap on tax season.

“It’s one of many largest advantages of e-Submitting with Buildium,” Walsh notes. “You can begin getting ready your batches, ensure tax information in your homeowners and distributors are up-to-date, double and triple verify your transactions, and extra. Taking good care of this all through December means you’ll save time and stress come January.”

Buildium calculates 1099 tax totals primarily based on the accounting information it has collected all through the tax 12 months. For those who haven’t been utilizing Buildium all 12 months, to not fear. You may edit the quantities at any time.

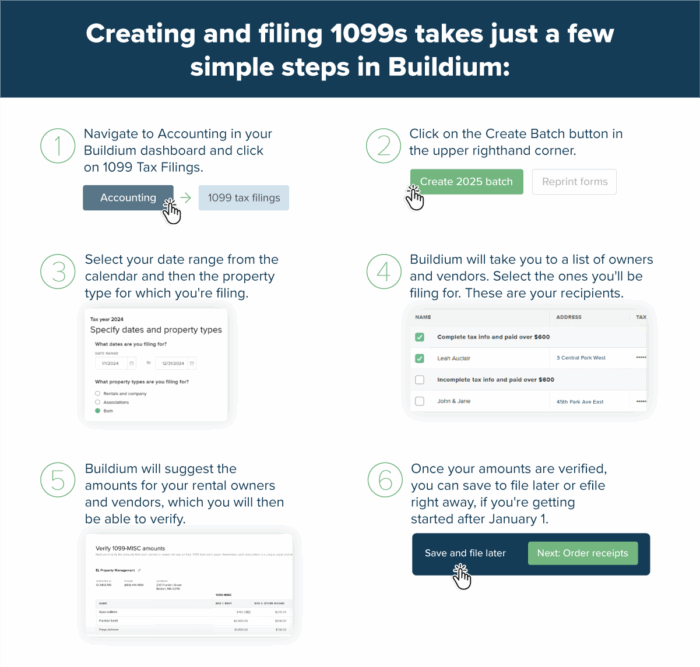

Creating and submitting 1099s takes just some easy steps in Buildium:

- Navigate to Accounting in your Buildium dashboard and click on on 1099 Tax Filings

- Click on on the Create Batch button within the higher righthand nook.

- Choose your date vary from the calendar after which the property sort for which you’re submitting.

- Buildium will take you to a listing of homeowners and distributors. Choose those you’ll be submitting for. These are your recipients.

- Buildium will counsel the quantities in your rental homeowners and distributors, which you’ll then have the ability to confirm.

- As soon as your quantities are verified, it can save you to file later or efile immediately, for those who’re getting began after January 1.

Staying on high of tax reporting is vital for any dimension property administration firm. Penalties for not submitting 1099 varieties can vary from $60 to $660 per type and deductions tied to the earnings might be disallowed for those who fail to file, which means the homeowners you’re employed with gained’t have the ability to declare the property bills as tax deductions.

Walsh calls out that one of many foremost issues property managers ought to look out for on this course of is time allocation: “It’s human nature to consider you’ve bought a number of time to care for one thing, however what we find yourself seeing a number of is folks find yourself laying aside e-Submitting their 1099s till the final minute,” he says. “That may doubtlessly result in errors in submitting, which might find yourself costing extra in the long term within the type of charges for ordering corrections. 1099s must be in your thoughts and getting checked off your to-do listing all all through January.”

Fortunately, property administration software program reminiscent of Buildium makes it simple to kick off the submitting course of early, does a number of the heavy lifting for you, and retains you properly forward of deadlines.

The trick is to discover a platform that’s easy to make use of, so that you’re not caught having to be taught new instruments on high of submitting taxes. Ease of use is among the main advantages that Walsh has seen throughout the shoppers he’s labored with, no matter portfolio dimension or expertise degree: “Clients discover the considered submitting 1099s daunting till they do it with Buildium. The software program takes the information you’ve already entered all year long and suggests which people to e-File for if you begin creating batches.”

Right here’s a peak into what the platform seems to be like in Buildium’s platform:

Bear in mind, understanding the ins and outs of your tax necessities is just half the battle. Selecting the best software program—a platform that retains your information organized and automates the onerous elements of submitting for you—is in the end one of the best ways to remain compliant and free to show your consideration to what issues. Relatively than trying again ultimately 12 months’s books, you possibly can give attention to reaching your online business objectives in 2026.

In order for you a better approach to file your property administration taxes this upcoming season, give Buildium toolkit a strive with a 14-day free trial or by signing up for a guided demo.

Steadily Requested Questions

What’s a 1099 type in property administration?

A 1099 type studies funds over $600 made to contractors, distributors, or service suppliers for rental property work.

Who must obtain a 1099 type?

Non-employee contractors, distributors, and repair suppliers who obtained $600 or extra yearly for rental property companies.

When do I must ship out 1099 varieties?

1099 varieties must be despatched out to the recipients by January thirty first of the 12 months following the tax 12 months during which the funds had been made. The IRS copy of the shape must be submitted by the top of February if submitting by paper, or by the top of March if submitting electronically.

What info do I would like to arrange a 1099?

To organize a 1099 type, you’ll want the contractor’s or service supplier’s identify, tackle, and taxpayer identification quantity (TIN). You’ll additionally want information of the full quantity paid to every recipient through the tax 12 months.

Can software program assist with 1099 preparation?

Sure, there are numerous software program options out there that may help with producing, managing, and submitting 1099 varieties. These instruments can simplify the method by monitoring funds and routinely populating the required info for every type.

What occurs if I don’t file a 1099 type?

Failing to file a 1099 type can lead to fines and penalties from the IRS. It’s vital to adjust to the reporting necessities to keep away from these points and hold correct information in your property administration enterprise.

Learn extra on Accounting & Reporting