Property Sentiment Index, September 2025

The OnTheMarket Property Sentiment Index explores how house movers are feeling concerning the property market, supported by knowledge from our personal platform. This version exhibits that the general public anticipate each gross sales and rental proces to rise over the subsequent 12 months whereas these planning to purchase, promote or hire stay assured to make their transfer inside six months or much less.

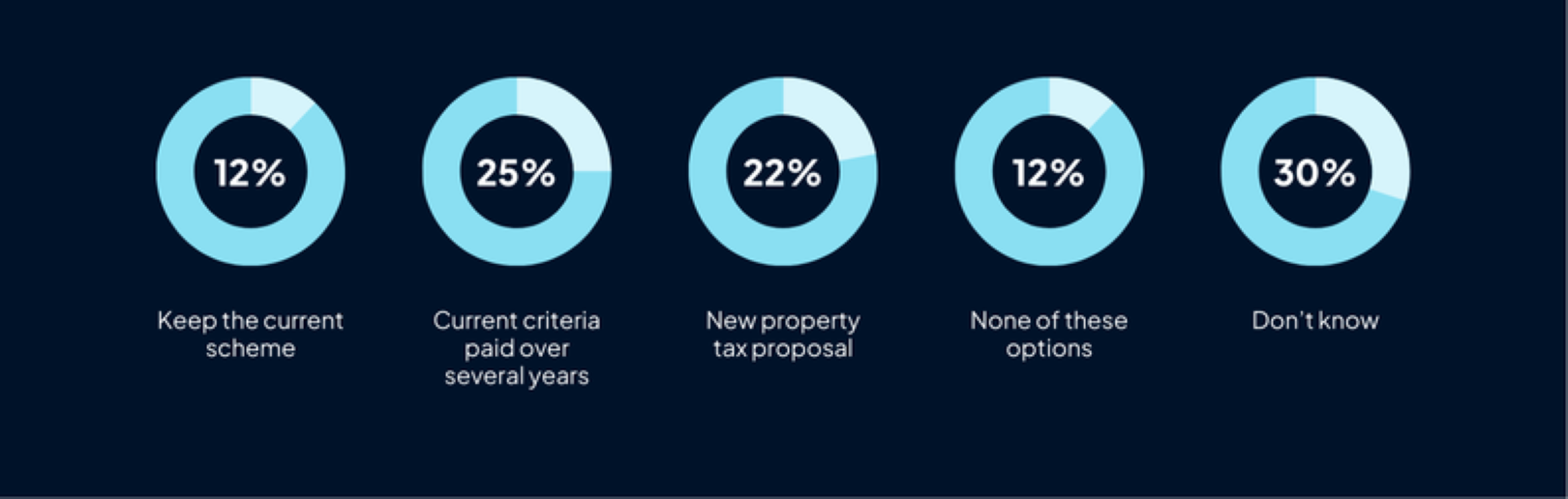

Moreover, there’s an urge for food for reform inside the property tax system, with solely 12% wanting the present system to stay in place unchanged. Nevertheless, opinions are break up in terms of selecting a substitute.

Sentiment in the direction of the property market

Gross sales market expectations

When waiting for the subsequent 12 months, just below half of property seekers consider home costs will enhance, a small fall from 51% who mentioned the identical three months in the past, suggesting a slight wavering in confidence within the UK property market. In the meantime, 24% consider costs will keep the identical, up from 21% within the earlier quarter, and solely 13% anticipate home costs to fall.

Vendor expectations

Amongst these trying to promote a property, 51% of all respondents, 4 in ten (38%) anticipate to obtain a suitable supply inside three months, whereas the identical proportion consider this may occur in three to 6 months (additionally 38%). Simply over one in ten (13%) predict they’ll settle for a proposal inside six to 9 months and 6% say inside 9 to 12 months.

Purchaser outlook

These trying to purchase a property, 74% of complete respondents, are typically assured that it received’t take lengthy to discover a house and have a proposal accepted. Equally to the June version, 4 in ten consider this may occur in three to 6 months, whereas an additional 37% anticipate it to take even much less time. Slightly below a fifth (17%) anticipate their search to take between six and 9 months.

Monetary confidence

Whereas nonetheless a majority, the numer of house movers feeling assured of their potential to boost the mandatory funds to purchase their subsequent property has dropped from 70% in June to 65%, with 42% feeling very assured and an additional 23% pretty assured. In the meantime, 11% really feel not very assured or not assured in any respect.

New houses

Curiosity in new houses has remained regular amongst property seekers, with 42% more likely to think about one as their subsequent property, a small change from 46% in June. Whereas 38% say they’re unlikely, up from 37% in June.

Rental market sentiment

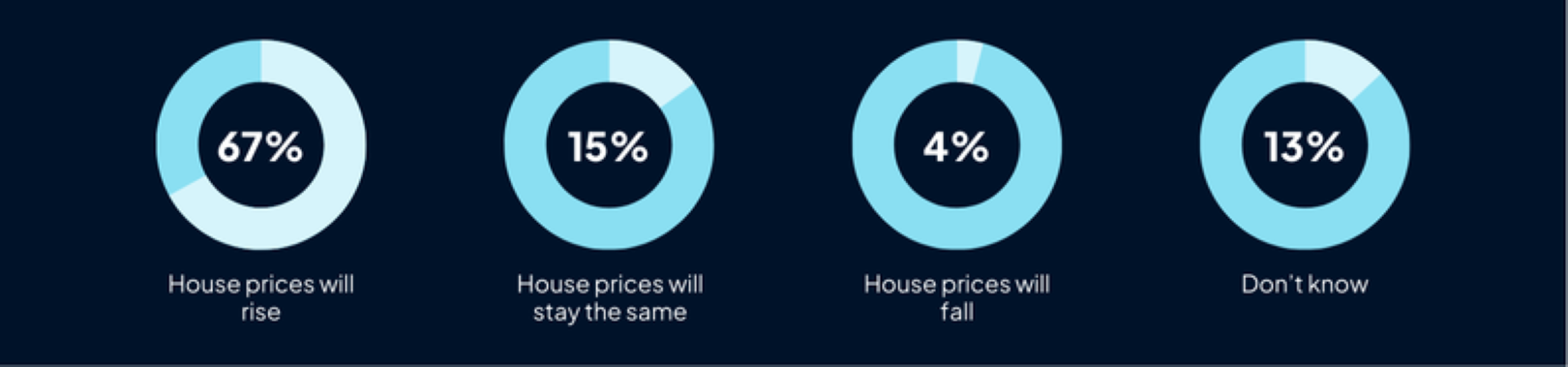

Contemplating rental costs, expectations replicate the dearth of provide and growing demand, as two-thirds (67%) anticipate costs to extend, the same proportion to June’s determine of 65%. In the meantime, 15% consider rents will keep on the identical stage, and solely 4% assume they’ll fall.

Renter outlook

Regardless of expectations for rents to extend, these trying to hire, 59% of complete respondents, stay assured of their potential to discover a property and have a proposal accepted shortly. Half consider they’ll have a proposal on a rental property accepted inside three months and an additional 29% anticipate it to take between three and 6 months. Lower than one in ten consider it’ll take six to 9 months (9%), 9 to 12 months (5%) or over a yr (6%).

Present occasions and coverage developments

Housing targets

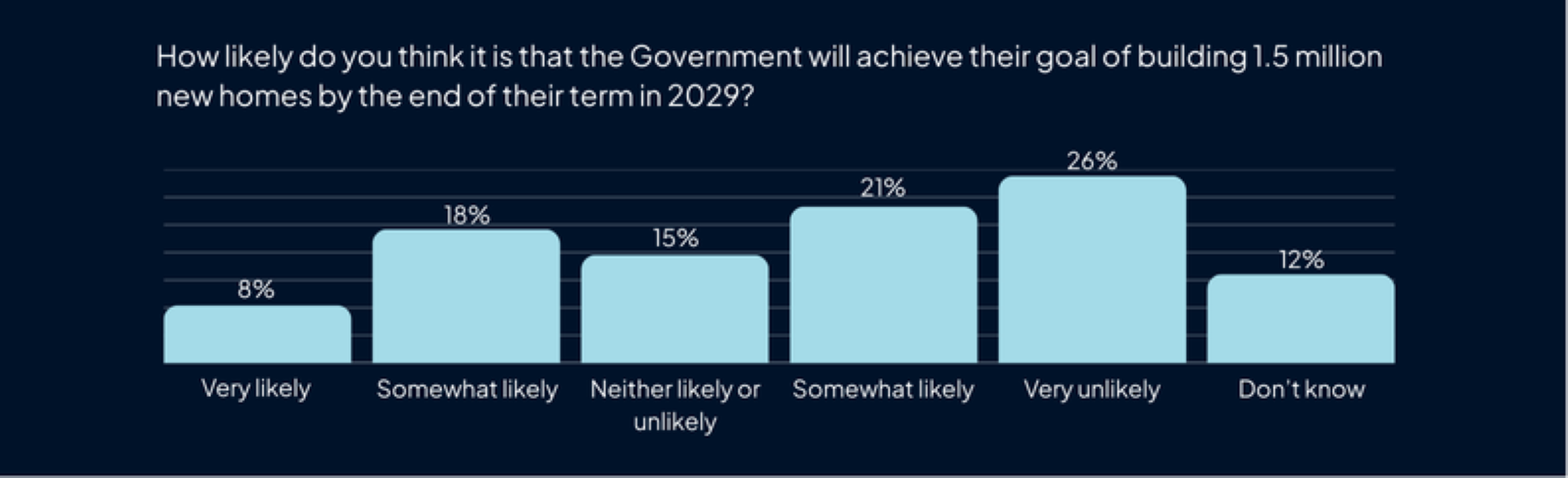

The federal government continues to face challenges in assembly its goal of 1.5 million new houses, with abilities and assets operating low. It comes as no shock, subsequently, that nearly half of respondents say the goal is unlikely to be met. 1 / 4 (26%) say it is vitally unlikely, whereas an additional 21% consider it to be pretty unlikely. This represents little change in comparison with June’s outcomes of 49%.

Then again, 1 / 4 of respondents consider the federal government is more likely to attain its goal of recent houses by the tip of its time period in 2029. Of those, 8% say it is vitally possible, whereas 18% consider it to be pretty possible.

Stamp obligation

Because the finish of the Stamp Obligation vacation in March, there was a lot dialogue about whether or not the property tax system ought to evolve with a spread of concepts floated thus far. Amongst respondents, solely 12% consider the present system ought to keep in place unchanged. 1 / 4 are in favour of retaining the identical standards however spreading funds over a number of years somewhat than requiring them up entrance. In the meantime, the same proportion (22%) help the newest proposition of introducing a property tax on any property valued over £500,000, with a better charge utilized to properties value over £1 million. Solely 12% say they help none of those three insurance policies and 30% mentioned they don’t know.

Rates of interest

Initially of this yr, the Financial institution of England’s base charge was set at 4.75% however has since dropped to 4%. In response, 30% of property In response,30% of property seekers say they’ve adjusted their search standards. The commonest change has been in searchers’ worth ranges (13%), whereas 6$ have modified the situation of their search and 4% have altered the variety of bedrooms of their potential properties. Some respondents deciding on “different” defined that they had determined to hire somewhat than purchase.

Trying to the longer term, opinions are blended on what is going to occur to rates of interest. 1 / 4 of property seekers anticipate charges to proceed to fall (26%), whereas simply over a 3rd (35%) consider they’ll keep on the present stage. Lower than one in 5 (!7%) anticipate charges to rise once more. Round 1 / 4 (23%) say they don’t know.

Whereas confidence within the pace of transactions stays robust amongst patrons, sellers and renters, patrons are additionally feeling optimistic about their potential to boost the funds wanted to buy their subsequent home.

Trying to present occasions, opinions are blended on what the way forward for property tax appears to be like like, with property seekers break up as as to whether the present system must be maintained or reformed. The yr’s rates of interest drops have affected the best way some are trying to find property, as many predict charges to remain on the present stage or drop additional.

We’ll proceed to watch shifts in sentiment and market exercise within the months forward and supply up to date insights in our subsequent version. Preserve studying for insights from OnTheMarket’s knowledge and feedback from brokers across the nation on their experiences over the previous couple of months.

Insights from the OnTheMarket web site

Key phrases

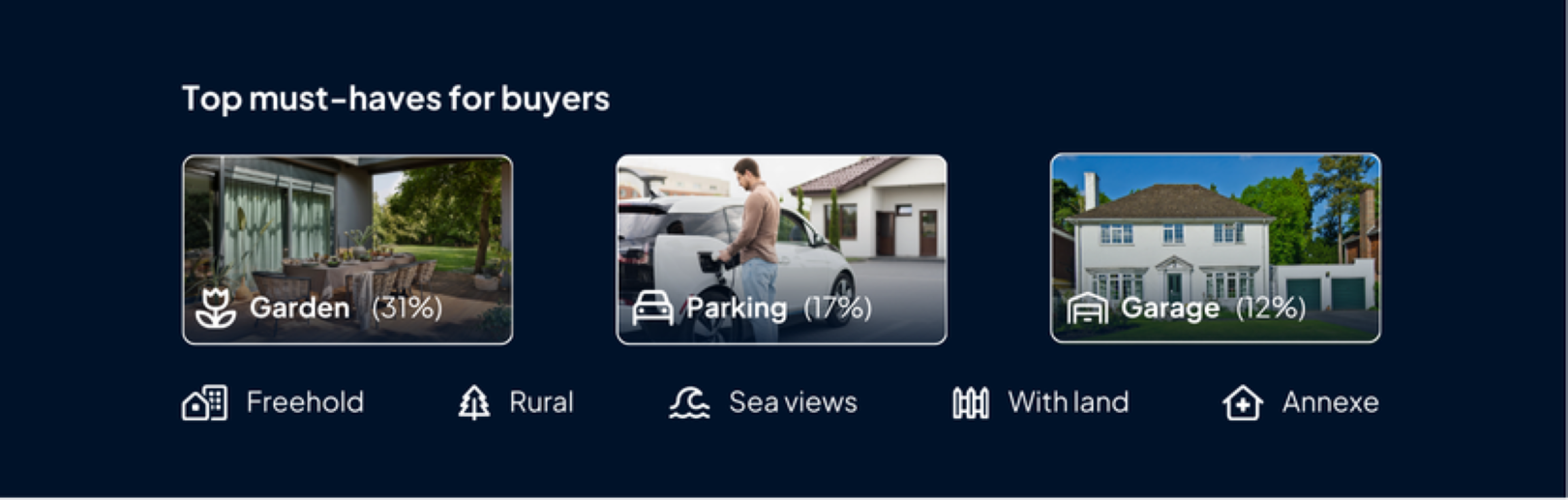

Our key phrase search instrument helps property seekers refine their search based mostly on particular options they need of their subsequent house.

For patrons, out of doors house is a transparent prioerty with gardens that includes in 31% of key phrase searches. Parking can also be extremely wanted (17%) together with garages (12%) whereas freehold properties and rural houses atrract related ranges of curiosity (each 7%).

Within the rental market, gardens once more high the record, showing in 29% of key phrase searches, with parking as soon as once more shut behind at 21%). Renters, nonetheless, have further concerns with 11% seek for “pets thought-about”, 10% for “payments included” and seven% for “furnished”.

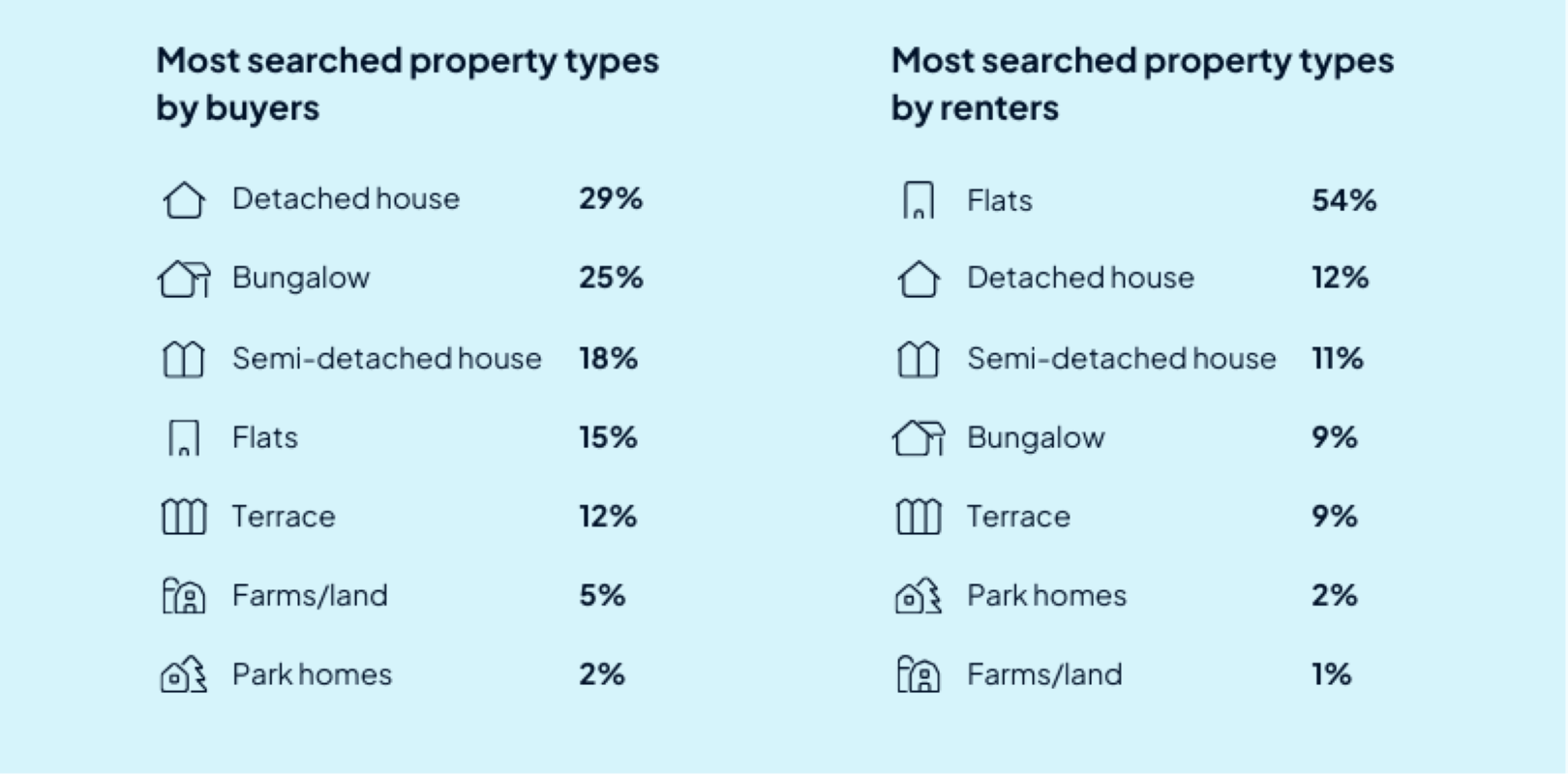

Property varieties

Filtering by property varieties stays on of essentially the most extensively used search choices.

Amongst patrons, indifferent homes are the preferred alternative (27%), carefully adopted by bungalows (23%). Semi-detached homes make up an additional 17% of searches whereas flats account for 15%.

Renters, then again, present a powerful choice for residences, which dominate 55% of filtered searches. Indifferent and semi-detached homes share related demand with 12% every, adopted by bungalows and terraced homes, each with 9% of filtered searches.

New directions

OnTheMarket has typically seen a development in new listings in current months, growing by round 5% every month as much as August. Nevertheless, final month noticed a seasonal dip, with new instruction falling by 15%, a standard pattern through the summer season as many sellers delay shifting plans whereas they go on vacation or benefit from the climate at house.

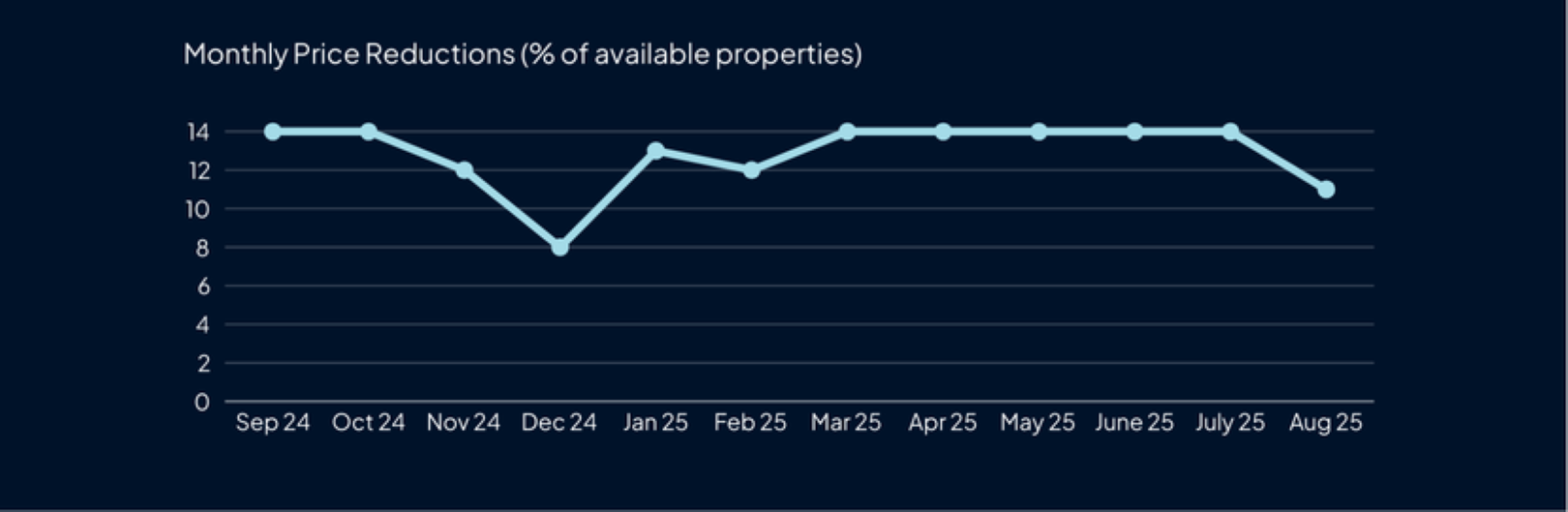

Worth reductions

The proportion of properties with worth reductions has remained comparatively steady in current months. In August, 11% of listings have been diminished, in contrast with 14% in each June and July. This consistency means that the small shifts following the tip of the Stamp Obligation vacation are regularly returning to extra acquainted ranges.

“With the November Price range on the horizon and ongoing financial uncertainty, patrons stay cautious and worth delicate. This yr we now have achieved document costs, each on a £ per sq. foot foundation and when it comes to actual values in sure roads, the place all properties have been turn-key.

“Many patrons are extremely knowledgeable, typically utilizing £ per sq. foot as a benchmark earlier than deciding which houses to view. Whereas some are ready to supply, persuading them to enhance their bids could be difficult, as they need reassurance that their buy will nonetheless signify good worth after the Price range or in a number of years’ time.

“With inventory ranges throughout London remaining excessive, bridging the hole between asking worth and achievable sale worth has been key. Smart pricing not solely reduces time available on the market however can even assist safe stronger outcomes. In reality, we now have achieved document costs for purchasers who adopted this method.

“Conveyancing is at the moment taking round 6–8 weeks. We strongly suggest that sellers instruct solicitors early and put together documentation upfront to keep away from delays, which solely add to purchaser uncertainty.”

“What we’re seeing throughout the market are centered patrons eager to get offers over the road, with exchanges and new purchaser registration ranges on par with 2024, regardless of an unsure financial and political panorama. The current resolution by the Financial institution of England to carry rates of interest at 4% has demonstrated a concentrate on stability: a pause that permits the market to regulate regularly and with larger confidence over the longer-term.

“While costs have adjusted in some native markets, others stay underpinned by excessive demand, creating a very regionalised image. Way of life-led strikes proceed to drive demand in places like Tunbridge Wells, Chester and Colchester, the place long-term worth outweighs short-term volatility. Completions stay robust in commuter hubs like Sevenoaks and Hale, reflecting the resilience of micro-markets that supply connectivity, group and high quality of life. Whereas these decided to finish earlier than Christmas are already deep into their transactions, money patrons now have a priceless alternative, with a wide array of properties out there to them.

“Homemovers are more and more centered on the tangible realities of at this time’s housing panorama. Our current analysis revealed that of the 15% of over 55s who plan to downsize would accomplish that inside the subsequent yr if stamp obligation have been eliminated or diminished on their onward buy, reflective of pent-up demand and a doable wave of movers topic to the outcomes of the Autumn Price range.

“As we enter the ultimate quarter of the yr, the message is evident; patrons are dedicated however now extra discerning. The precedence for coverage makers have to be to supply additional stability that may breed confidence, gasoline transactions, and help homemovers on their journey.”

“After a surprisingly busy few months of transactional exercise in any respect ranges of the agricultural property company market, the drip feed of potential adjustments to the taxation of each housing and housing transactions has introduced a layer of warning into {the marketplace}.

“On the greater finish of the market – particularly round properties value in extra of £1.5m – there’s extra warning as the opportunity of introducing capital positive factors tax to precept personal residences has been rumoured to be introduced in November’s Price range.

“Nevertheless, the marketplace for properties value lower than £1.5m is standing up very nicely. Doable reforms to stamp obligation are more likely to be unlock exercise amongst patrons, and our New Properties workforce are additionally very busy, which bodes nicely for the way forward for home constructing and residential possession.”

Methodology

Between Friday 22 and Saturday 30 August, over 2,500 lively property seekers who’ve not too long ago signed up for property alerts or despatched a property enquiry at OnTheMarket participated in our survey. This group represents engaged people at the moment navigating the UK property market. Breaking respondents down into:

- 1331 (50%) are actively searching for a property to purchase

- 1345 (51%) have a property to promote

- 1571 (59%) are actively searching for a property to hire

The place totals don’t add as much as 100%, this is because of rounding.

Information on key phrases, property varieties, new directions and diminished properties is for June to September and is drawn from OnTheMarket’s knowledge compiled from 1000’s of property agent branches and housebuilders who record their properties with OnTheMarket each month.

The information for key phrases and property varieties is said to all searches which have used these filters and doesn’t embody data regarding searches with out them.

For all enquiries, please contact Amelia Collins (acollins@onthemarket.com)