Key takeaways from November’s Home Value Index

- Common new vendor asking value: £364,833 (-1.8% month-on-month, -0.5% year-on-year)

- Agreed gross sales year-to-date: +4% versus identical interval in 2024

- November value fall: -1.8%, the biggest fall presently of yr since 2012

- Higher-end impression: Gross sales agreed for £2m+ properties down 13% year-on-year, whereas £500k-£2m properties down 8%

- Value reductions: 34% of properties in the marketplace have had asking value cuts, which is the very best since February 2024

The most recent information exhibits asking costs down 1.8% since final month and 0.5% beneath this time final yr, as Finances rumours and a decade-high variety of properties on the market imply some would-be movers are choosing a ‘wait and see’ method.

The housing market at a look

November often brings a seasonal slowdown in each exercise and costs because the market heads in the direction of the quieter Christmas interval, however this yr the drop has arrived earlier and extra sharply than standard. Common new vendor asking costs have fallen by 1.8% (-£6,591) to £364,833, which compares to a mean drop of 1.1% over the earlier 10 years presently. It’s the biggest November fall we’ve seen since 2012.

The reason being fairly clear: the decade-high degree of property alternative means sellers don’t have a lot pricing energy, and plenty of are being cautious about not over-pricing in comparison with their competitors. What’s extra, the Finances – which is later within the yr than standard – has been a giant distraction, with many would-be patrons ready to see how their funds can be impacted earlier than making their transfer.

Whenever you have a look at the year-to-date image although, there are nonetheless figures that present a number of individuals are nonetheless making strikes. The variety of gross sales agreed to date in 2025 continues to be up 4% on the identical interval in 2024, displaying that underlying demand stays stable when you look previous the headline stats.

Regional home value developments

Value actions this month diversified considerably throughout the nation, with all areas seeing month-to-month falls. Scotland noticed the biggest month-to-month drop at -3.2%, although it maintained optimistic annual progress of +0.4%. London fell by -2.4% month-on-month and -2.1% yearly, whereas Yorkshire and The Humber dropped -2.4% month-to-month however remained flat on an annual foundation.

| Area | Annual change | Key remark |

|---|---|---|

| London | -2.10% | Finances uncertainty notably impacting higher finish |

| Scotland | +0.40% | Quickest time to safe patrons (34 days) |

| North East | +2.40% | Highest annual progress throughout all areas |

| Yorkshire and The Humber | +0.00% | Flat annual change after largest month-to-month fall |

Supply: Rightmove Home Value Index, November 2025

What’s driving the market?

The upcoming Finances, and the long term as much as it, has created hesitancy. Hypothesis about potential property tax adjustments that might disproportionately have an effect on the higher finish of the market has grabbed headlines in latest months, and our information exhibits the present hesitancy is inside this sector. Gross sales agreed for £2 million+ properties, which have been the topic of potential mansion tax rumours, are down 13% year-on-year. Houses priced between £500,000 and £2 million, which might be impacted by rumoured stamp obligation adjustments in England or capital features tax changes, have seen gross sales agreed drop by 8% year-on-year.

What’s extra, with property alternative at its highest degree in a decade, patrons positively have the higher hand. Over a 3rd (34%) of properties at present in the marketplace have had an asking value discount, with the typical measurement of discount being 7%. Each figures are the very best since February 2024, making this very a lot a patrons’ market in the mean time.

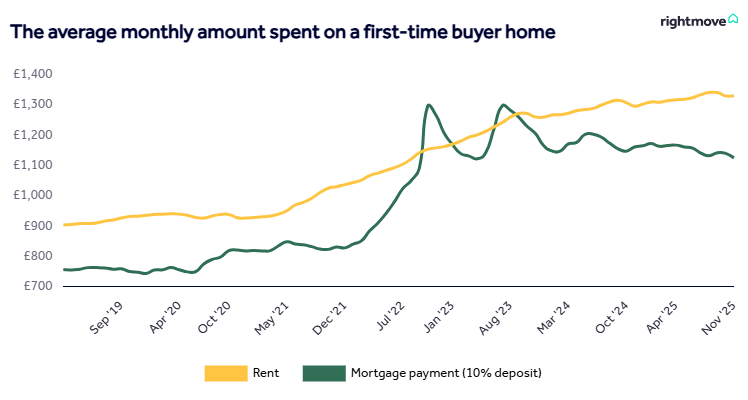

In the meantime, the typical two-year fastened mortgage price is at present 4.41%, in comparison with 5.06% presently final yr. Whereas the Financial institution of England held the Base Fee in November, the markets are at present predicting a 0.25% reduce on the last assembly of 2025, in December.

What do the consultants suppose?

Our property professional, Colleen Babcock, says: “The last decade-high variety of properties out there in the marketplace continues to limit value progress, with many new sellers eager to keep away from standing out by over-pricing in contrast with their competitors. The Finances is a giant distraction, and is later within the yr than standard, with many would-be patrons ready to see how their funds can be impacted. It seems that the standard lull we’d see round Christmas time has arrived early this yr, and sellers who’re eager to maneuver are having to work particularly laborious to entice patrons with aggressive pricing. Which means that common new vendor asking costs at the moment are 0.5%, or £1,759, cheaper than a yr in the past.”

Matt Smith, our mortgage professional, provides: “The Financial institution opted to keep up the established order forward of the extensively anticipated Finances, however there’s nonetheless a very good probability of one other price reduce earlier than the tip of the yr. We’re beginning to see some notable weekly drops in charges, with some mortgage lenders providing headline-grabbing low-cost charges as they compete for end-of-year enterprise. Dwelling-movers can anticipate some small drops in common mortgage charges to proceed over the subsequent few weeks. The Finances has created a variety of uncertainty and has had a giant build-up, so as soon as the bulletins are out the way in which, home-movers can give attention to planning with extra confidence.”

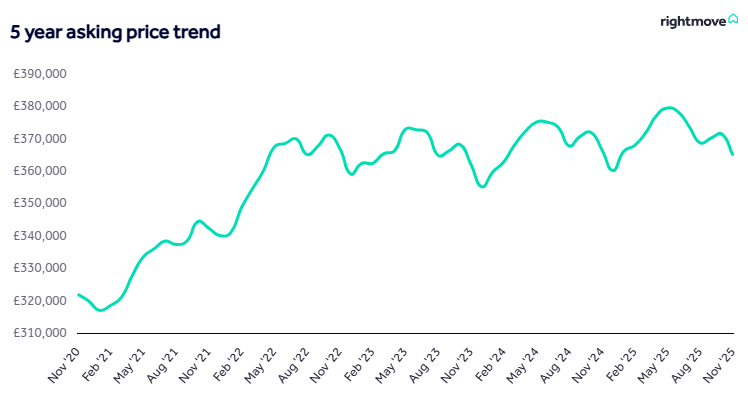

How have asking costs modified over the previous 5 years?

How a lot are first-time patrons spending every month on common?

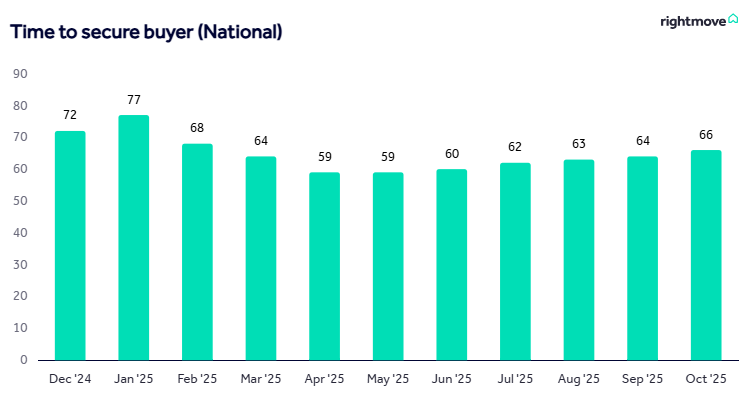

How lengthy does it take to discover a purchaser for a house on common?

READ MORE: 10 quickest markets for sellers

READ MORE: 10 quickest markets for sellers

.png?w=150&resize=150,150&ssl=1)