I hung up the telephone with a large grin plastered throughout my face. One in every of my oldest buddies, who I’ve identified since I used to be 14, simply known as to inform me that he was getting married! And the marriage was going to happen in just some months in July. In Barcelona.

There was only one slight drawback. I used to be nowhere close to Barcelona. In truth, I used to be precisely 7,919 miles away on the island of Oahu, Hawaii. Which meant that I wanted to ebook a flight actually internationally throughout the busiest journey season of the 12 months.

As you may guess, flying 30 hours from Honolulu to Barcelona was not going to be low cost. However I knew precisely what to do. In any case, I’ve been flying all over the world for nearly a decade. I prefer to assume I’ve discovered a factor or two.

It was time to place my journey hacking expertise to the check. So I started working.

How I Booked a First Class Ticket Across the World for $5.60

With just some months till the marriage, I knew I wanted to ebook a flight quick. Sadly, Honolulu to Barcelona shouldn’t be a simple path to fly. With no direct route, I used to be two layovers and nearly 30 hours of journey time.

- Possibility 1: Pay $500 or so for the flight in cattle class. 30 hours from airport to airport? Hell to the no.

- Possibility 2: Pay $8k for a firstclass ticket. Yeah, I don’t assume so.

- Possibility 3: Pay 5 bucks and let my factors do the heavy lifting. Sure please!

Now look, I’m not towards flying financial system. If I can rating deal and go to sleep, then I’m completely happy to pay for an inexpensive seat. However with 30 hours of journey time forward of me, and with sufficient long-haul flights behind me, I knew it was going to be one lengthy, hellish trip in financial system.

So I checked my factors stability to see what I had.

Journey hacking isn’t nearly accumulating miles. It’s about figuring out when, the place and the right way to maximize your factors in an effort to save probably the most on journey.

All through the years, Chase has been my major financial institution of alternative. I’ve their Sapphire Reserve, Most well-liked, Ink Enterprise Plus and MileagePlus Explorer playing cards. Come to think about it, that in all probability makes me the last word Chase fanboy.

And in consequence, I’ve racked up thousands and thousands of factors through the years. And these had been factors that I might use in the direction of my flight to Barcelona.

See, it’s not essentially about getting factors to arrange for a particular journey. It’s about accumulating factors for the sake of getting them available to make use of when particular or extenuating circumstances come round.

So, What, Precisely, Is Journey Hacking?

Journey hacking is a strategic approach of accumulating award factors after which redeeming them in a approach that will get you probably the most financial institution on your buck. And typically you may even get all bang with out spending a buck in any respect.

Which, yep, means free—or almost free—journey. I’m speaking free flights, free upgrades to top notch and even free lodge stays.

Journey hacking is extra than simply accumulating frequent flyer miles and lodge factors. It’s about figuring out when, the place and the right way to maximize these factors in an effort to save large on journey.

Upon getting sufficient factors, you’ll be capable of redeem them for discounted or free flights, also called award fares. Primarily, you may consider your factors as a particular foreign money.

Belief me, journey hacking is simple to grasp. You need to use your factors to unlock a world of low cost journey, so long as you’re strategic about it. To be completely sincere, getting the factors is the straightforward half. The actual trick lies in studying how greatest to redeem them.

Step 1: Discover the Airways with the Finest Routes Accessible

So, my first step was to determine which airways flew from Honolulu to Barcelona. And that’s the place flight comparability web sites like Google Flights and Skyscanner actually shine. They search by a number of journey websites to point out airways that fly the very best route for probably the most reasonably priced worth.

On this case, worth wasn’t a lot of a problem, since I knew I needed to redeem factors to pay for it. So, principally, I used to be trying to see which airways flew probably the most environment friendly route. It was a protracted flight, so discovering a simple flight path was vital.

I discovered just a few flight choices that seemed interesting, however they had been just about all on both United Airways or Turkish Airways, which is definitely only a companion of United.

So United it was.

Step 2: Search for Totally different Methods to Guide Award Fares

The quickest strategy to redeem your factors is to ebook an award flight is thru your bank card’s on-line portal. You’ll be able to search dozens of airways, resorts and actions in a single go. And, should you don’t have sufficient factors out there, you may spend what you’ve and cost the remainder to your card.

However reserving by the web portal comes with disadvantages. The worth of the purpose is fastened, so the required variety of factors might fluctuate relying on the flight worth. Below most circumstances, you must by no means do that. They nearly by no means provide the very best deal, however I at all times test it simply to get a baseline concept of what a “common” award fare would appear to be.

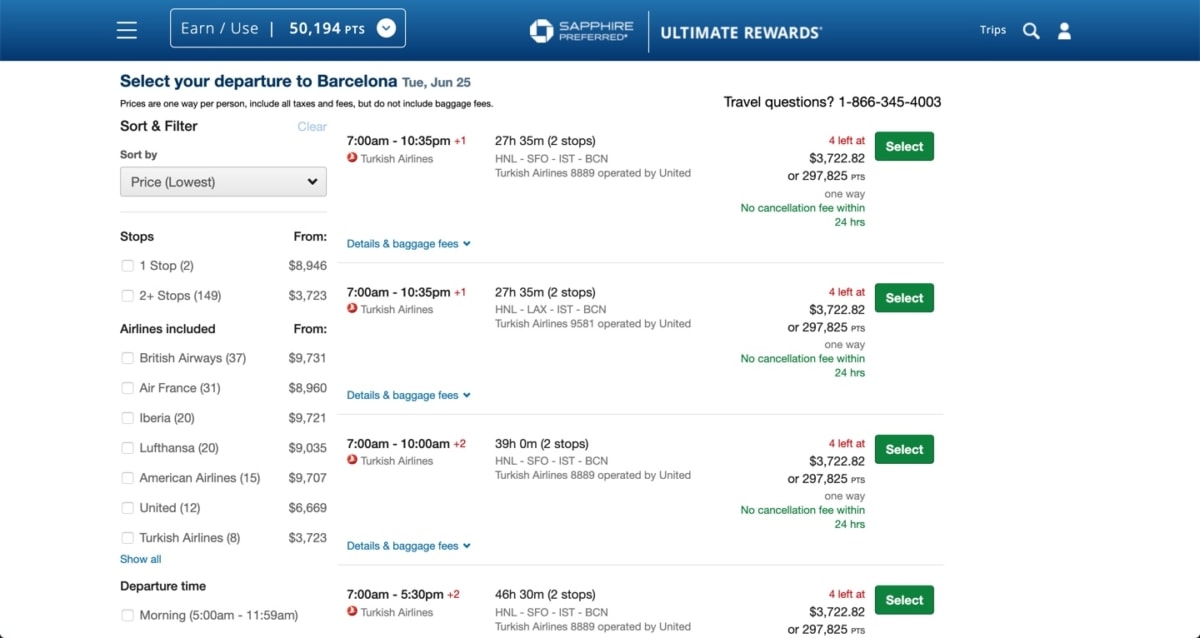

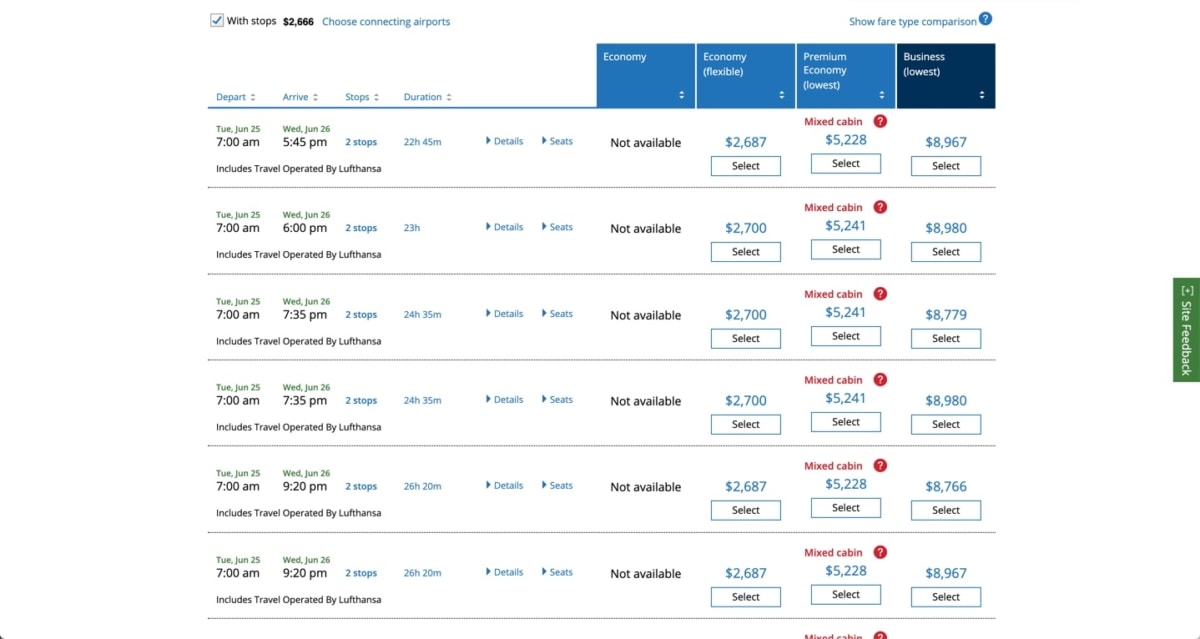

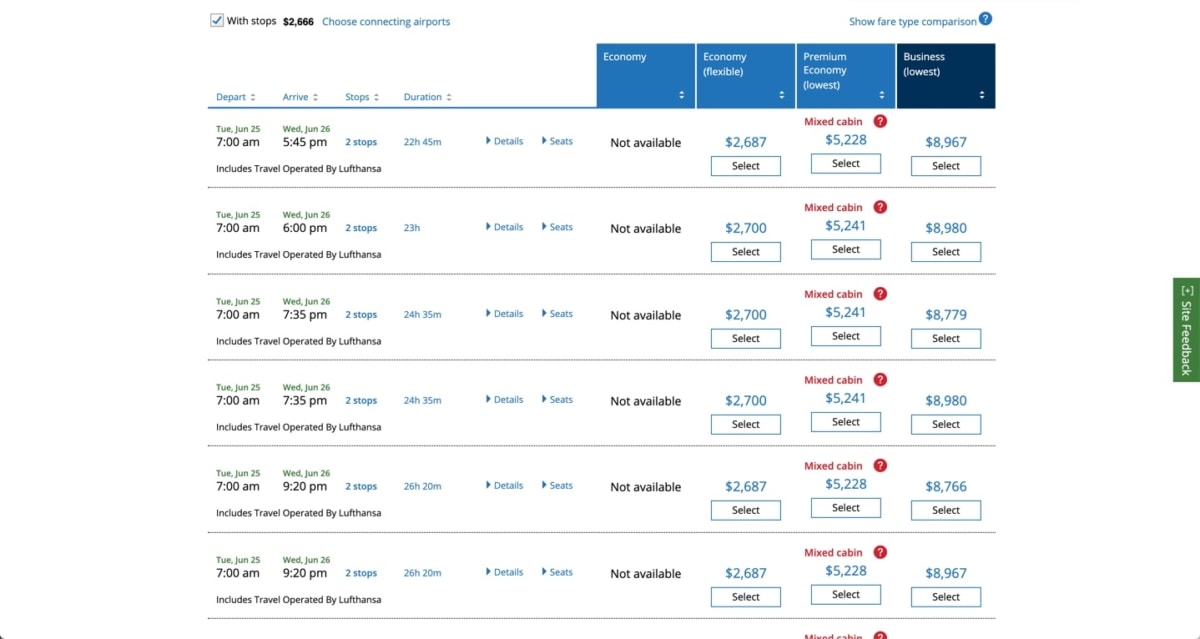

Understanding that I might be redeeming my Chase factors, I checked their reserving portal to see what they had been providing. And, as I anticipated, Chase’s level valuation was too low. They needed almost 300,000 factors for a mixed-class flight in enterprise (a mixture of financial system and enterprise seating) and greater than 900,000 for a flight in first! That’s approach greater than I used to be keen to half with—and I knew I might do higher. So much higher.

By doing a bit of my very own analysis, I additionally discovered that these enterprise class flights had been truly in United Polaris. And whereas there’s a slight distinction in service, Polaris First and Polaris Enterprise are basically the identical product. For many who need to get technical, they’re completely different flight courses, sure, however actually, I take into account any seat in Polaris to be top notch.

One other strategy to redeem factors is to switch them to your airways loyalty program. This turns your reward factors instantly into frequent flyer miles that can be utilized in the direction of the flight buy or an improve with that airline.

However, when reserving a flight utilizing frequent flyer miles, flexibility is essential. The airline would possibly implement blackout dates or have restricted seat availability for award journey. So it’s greatest to maintain your journey dates open.

And when you’re extra more likely to get a greater return by transferring the miles, it’s not at all times the case. You’ll have to do the mathematics to see the place you get extra bang on your buck.

Step 3: Use Level Valuations to Discover the Finest Award Fare

Understanding that United had the very best flight between HNL and BCN, and figuring out that the Chase Reserving Portal didn’t provide an excellent level valuation on this flight, I made a decision to test the United web site instantly.

You see, the worth of some extent depends upon the bank card and the frequent flyer program. For instance, Chase Final Rewards factors might be redeemed for between 1 and 1.5 cents every if reserving by the Chase Final Rewards portal.

However right here’s the factor—you would possibly be capable of stretch your factors even additional by transferring them right into a frequent flyer program with an airline. And that’s precisely what I did.

In accordance with all people’s favourite tipster, The Factors Man, Chase Final Rewards factors ought to have a price of two.1 cents every when transferred to an airline. That’s greater than twice the potential worth than should you ebook by the portal!

Utilizing this baseline of two.1 cents per level, I might ensure the flight I redeemed both matched or exceeded that valuation. And since I financial institution with Chase, all my factors switch to the United MileagePlus program at a 1:1 ratio.

Step 4: Guide the Flight with the Finest Level Valuation

So, how did my factors break down?

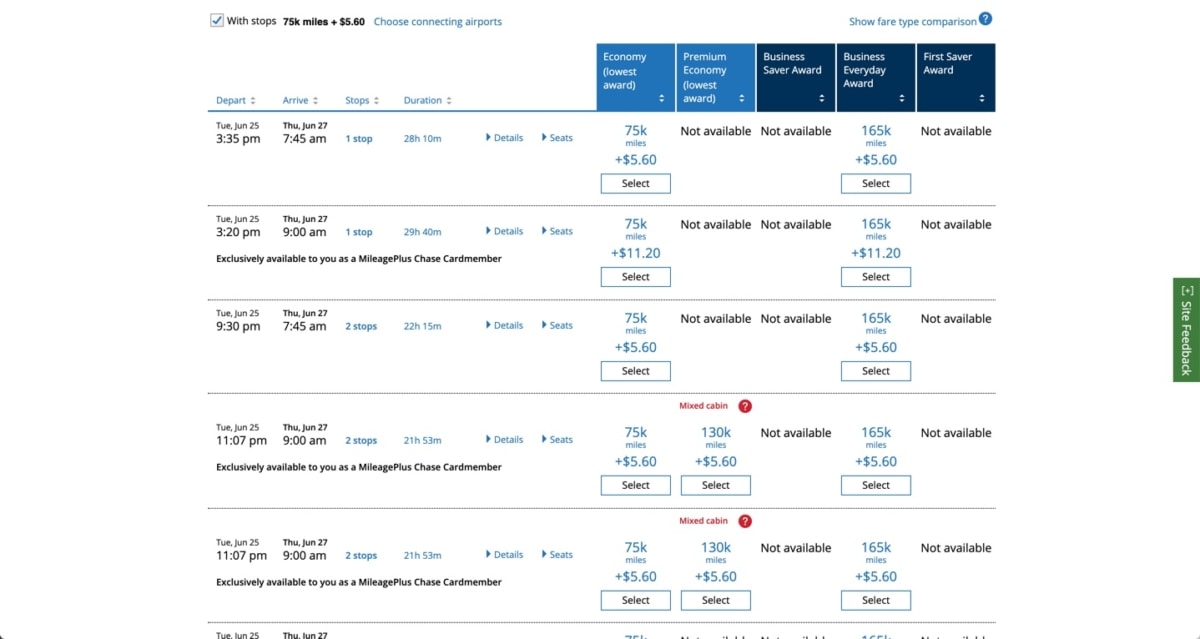

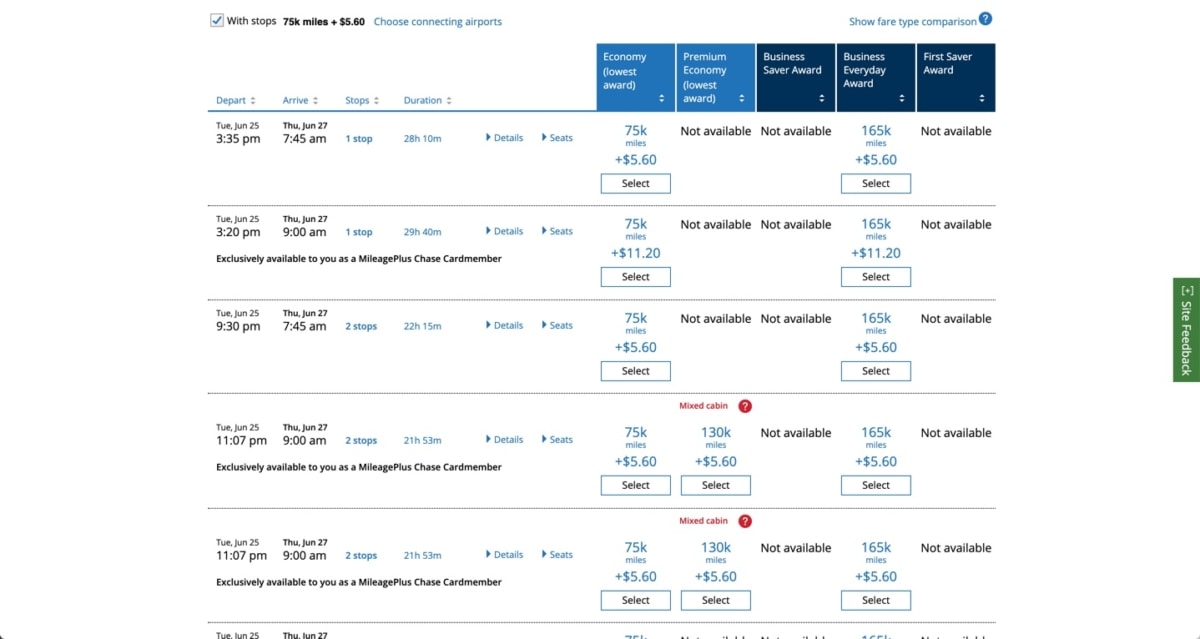

On the United web site, my flight value $8,967 a technique. I then looked for an award fare (which United makes very simple), and there have been fairly just a few choices. I might spend 70,000 factors for a ticket in financial system or 165,000 factors for a ticket in United Polaris—their model of first/enterprise class with lie-flat beds.

Based mostly on the two.1 cent valuation and 1:1 switch ratio, if I booked utilizing 165,000 factors, the money worth of the flight dropped right down to $3,360.

In different phrases, an $8,967 ticket in United Polaris truly solely value $3,360 if I paid utilizing factors instantly by United MileagePlus. However in actuality, the flight solely value me $5.60.

I logged into my Chase account, transferred the factors to my United MileagePlus account (it’s an instantaneous switch), and booked the flight for 165,000 factors—all of which I earned completely free.

After just a few clicks, 165,000 factors and a five-buck bank card cost, I had a first-class flight to Barcelona, all the best way from Hawaii. Not unhealthy, eh?

Simply Earn Miles and Factors

This type of journey is definitely actually simple. Sure, it takes time to build up factors, however should you begin quickly—even should you don’t have a visit deliberate—you’ll have the miles available for everytime you determine to take off sooner or later.

However how do you even earn these factors within the first place? Regardless of what you would possibly assume, you don’t truly need to journey in an effort to get them!

1. Look forward to a Huge Signal-Up Bonus with a Credit score Card

The quickest strategy to earn reward factors is to enroll with a bank card that has a beneficiant signup bonus for brand new prospects. The variety of reward factors differs between firms and may change relying on the time of 12 months. So it’s at all times greatest to attend for a particular deal that gives the utmost variety of bonus factors.

Remember that you’ll solely earn the factors after spending a sure greenback quantity within the first few months. However should you rating signup bonus, and you recognize you may meet the minimal spend requirement, there’s nearly no motive to not.

One thing actually vital to notice is that signing up for bank cards doesn’t negatively influence your credit score rating. Many individuals don’t join bank cards as a result of they assume it’s going to harm their credit score rating, however that’s truly not true. You would possibly get a small ding in your credit score report and, okay, your rating would possibly drop by a pair factors (actually, only a couple factors), however that’s short-lived.

Since credit score scores are extremely influenced by your credit score utilization, opening a brand new bank card can truly improve your credit score rating. With the next credit score restrict and a decrease utilization proportion, there may be truly extra to realize.

Many journey hackers—myself included—open and shut bank card accounts on a rotating foundation, only for the sake of incomes sign-up bonuses, all whereas incomes doubtlessly thousands and thousands of factors per 12 months (severely). They usually do that whereas sustaining glorious credit score scores.

2. Earn Factors on On a regular basis Purchases

Upon getting certainly one of these bank cards, you need to be charging actually every thing to your card. Most provide at the least one level per greenback spent. Nonetheless, there are different playing cards that can double and even triple the variety of factors you earn.

Some playing cards—like my private favourite, the Chase Sapphire Reserve—provide three factors for each greenback you spend on journey. So, whether or not you’re taking an Uber or reserving a flight, you stand to earn thrice as many factors while you ebook in your card.

Different playing cards provide comparable multiplier bonuses while you cost at bars, eating places, grocery shops, fuel stations, workplace provide shops, and extra. Every card provides completely different bonuses, so it’s vital to do your analysis and get the playing cards that make most sense for the way and the place you spend.

That is by far one of many best methods to maximise your factors. By merely utilizing your bank card on unusual purchases, you may rack up mass quantities of factors in a brief time period.

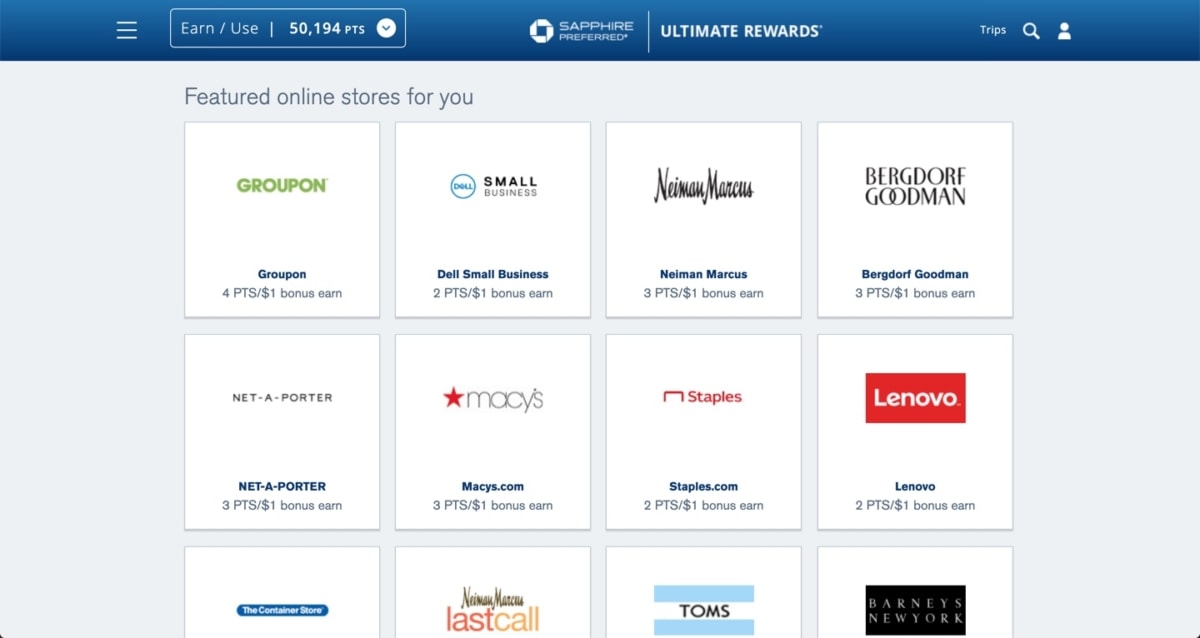

3. Store By way of the On-line Buying Portal

Nearly each airline loyalty program or bank card firm has a web based buying portal that connects instantly the manufacturers and outlets you recognize and love. In case you’re a giant on-line shopper, then you may earn bonus miles simply by clicking by the portal first. That is one other one of many best methods to earn factors with out ever taking a flight.

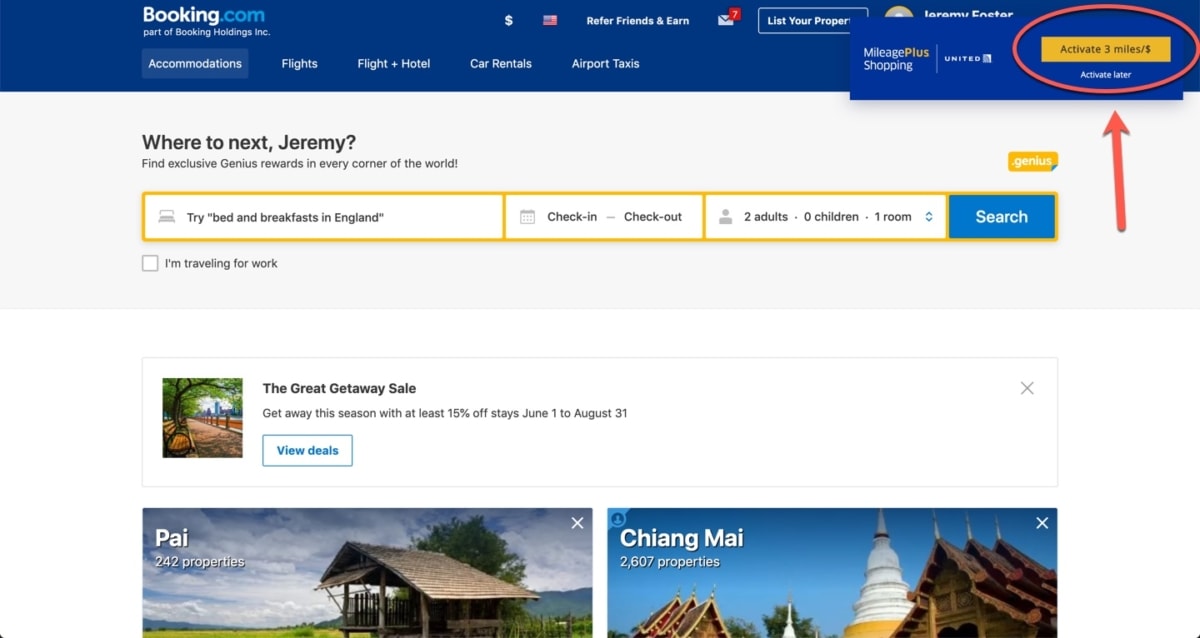

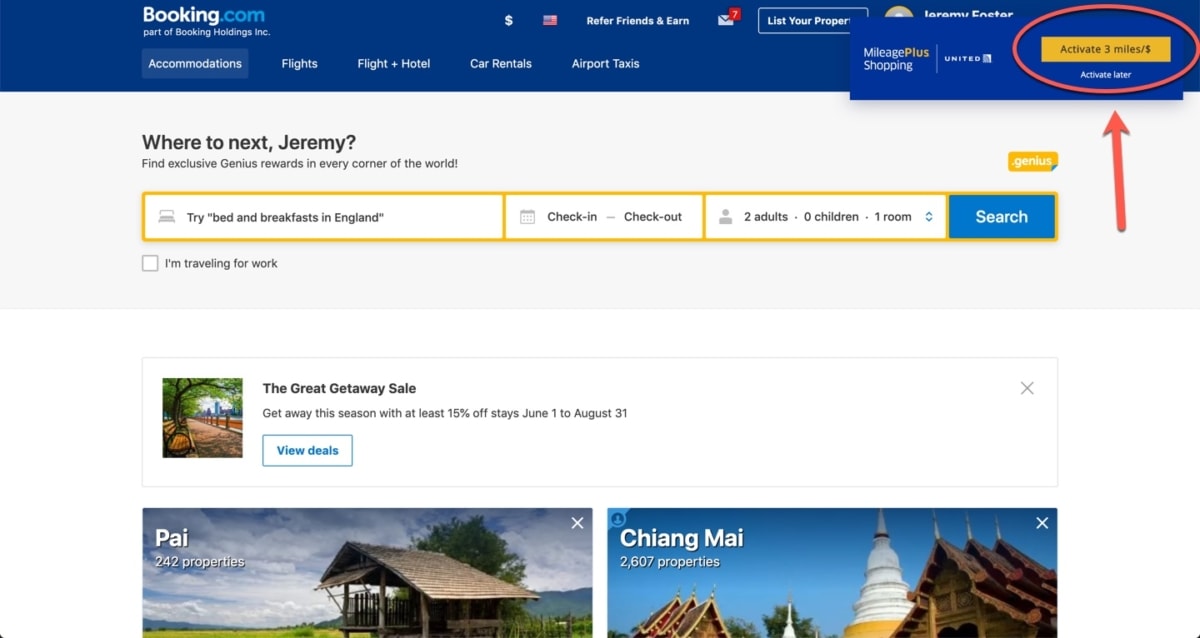

Residing on the east coast of the States, United was the airline that almost all usually linked me to the locations I needed and wanted to go. So I put in the MileagePlus Buying extension in my browser, and now, each time I go to an internet site to purchase one thing, it exhibits me if there’s a multiplier out there for that service provider.

That is when issues can begin to get actually profitable. Whenever you mix your bank card multipliers with loyalty program multipliers, you may earn a heck of much more factors.

For instance, United MileagePlus provides three factors per greenback on all purchases made on Reserving.com. So, should you ebook on a bank card that’s providing you with three factors per greenback, just like the Chase Sapphire Reserve, and you ebook it by the MileagePlus portal, you’re truly incomes SIX POINTS PER DOLLAR on that transaction. That form of return is insane, and if you consider level valuations, as an alternative of incomes the unique 1 or 1.5 cents per greenback, you’re incomes greater than 10 instances extra at 12.6 cents per greenback.

And that is solely the tip of the iceberg.

There are a lot of the way to earn factors, however by far, the best is thru bank card signups, bonuses and strategic spending. Lately, anytime I spend a single greenback, I take into consideration how I would be capable of maximize that greenback for factors. As an alternative of buying blindly, I’m extra calculated in how I spend my cash, and which bank cards I’m utilizing, which implies I’m getting probably the most bang for each buck I spend.

It would sound intimidating at first, however it’s important to begin someplace. And while you’re on a 30 hour flight internationally, stress-free in top notch with a lay-flat mattress and free booze, you’ll by no means end up questioning, “What’s the purpose?”

(See what I did there?)