Key takeaways from December’s Home Worth Index

- Common new vendor asking value in December 2025: £358,138 (-1.8% month-on-month, -0.6% year-on-year)

- Agreed gross sales year-to-date: +3% versus identical interval in 2024

- December value fall: -1.8% – bigger than the 10-year common drop of 1.4%

- Funds impression: First half of 2025 noticed new sellers up 9% and purchaser demand up 3% versus 2024, however this reversed to -4% and -6% within the second half of the yr, as folks waited to see what was introduced within the late-November Funds

- Subsequent yr: Rightmove predicts asking costs will rise by 2% in 2026

Our newest information exhibits asking costs are down 1.8% month-on-month and 0.6% beneath final yr, as 2025 ends with the Funds uncertainty behind us and an improved affordability image. This units the stage for a stronger 2026.

Nationwide market overview

December normally brings a seasonal slowdown in each exercise and costs because the market heads into the Christmas interval, however this yr the drop mirrors November’s fall. Common new vendor asking costs have fallen by 1.8% (-£6,695) to £358,138, which compares to a median drop of 1.4% over the earlier 10 years at the moment. It signifies that 2025 ends with common asking costs 0.6% (-£2,059) decrease than a yr in the past.

Funds-related uncertainty amplified the seasonal slowdown that we’d normally see in December. While you have a look at the total yr although, issues are extra optimistic than current months recommend. The variety of gross sales agreed in 2025 is 3% larger than in 2024, displaying that regardless of the Funds construct up, the underlying market remained resilient.

Nationwide common home value

| Month | Common asking value | Month-to-month change | Annual change |

|---|---|---|---|

| December 2025 | £358,138 | -1.8% | -0.6% |

| November 2025 | £364,833 | -1.8% | -0.5% |

Nationwide common home costs by property sort

| Sector | December 2025 | November 2025 | Month-to-month change | Annual change |

|---|---|---|---|---|

| First time consumers | £221,950 | £225,128 | -1.4% | -1.4% |

| Second steppers | £334,297 | £340,515 | -1.8% | -0.5% |

| High of the ladder | £642,131 | £657,758 | -2.4% | -0.2% |

Regional home value developments

Nearly all areas skilled value falls in December, with the North West standing out as the one area to document progress, up 0.1% month-on-month. The North West additionally leads the nation with the strongest annual value progress of two.6%.

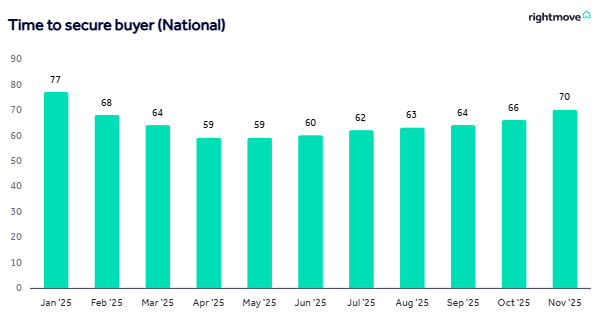

The North East skilled the sharpest month-to-month decline at (-5.1%), whereas Scotland noticed a major month-to-month drop of three.2%, although it maintained optimistic annual progress of 1.3%. Regardless of the month-to-month fall, Scotland continues to be by far the quickest market in Nice Britain, with properties taking simply 37 days on common to discover a purchaser – considerably sooner than the 59-78 days typical throughout England and Wales.

London costs fell by 1.2% month-on-month and completed the yr flat at 0.0% yearly. This displays the continuing challenges within the capital as consumers and sellers regulate to stamp obligation modifications and anticipate the upcoming mansion tax.

Supply: Rightmove Home Worth Index Dec ’25

What’s driving the market?

The info highlights the stark distinction between the primary and second halves of 2025, with Funds hypothesis impacting the latter a part of the yr. The variety of new sellers coming to market within the first half of 2025 was 9% forward of the identical interval in 2024. In contrast, the variety of new sellers within the second half was 4% beneath the identical interval final yr.

What’s extra, the impression prolonged to consumers too. Purchaser demand was 3% larger than 2024 throughout the primary half of the yr however rotated to be 6% behind throughout the second half. Our survey of over 10,000 potential movers revealed that almost one in 5 have been ready for the result of the Funds to renew their shifting plans.

Studying between the traces

particular person months, the weaker year-on-year developments within the second half have been exacerbated by evaluating in opposition to a powerful 2024 interval when consumers rushed to finish earlier than April’s stamp obligation will increase in England. This comparability impact has made current months look weaker than the underlying market actuality.

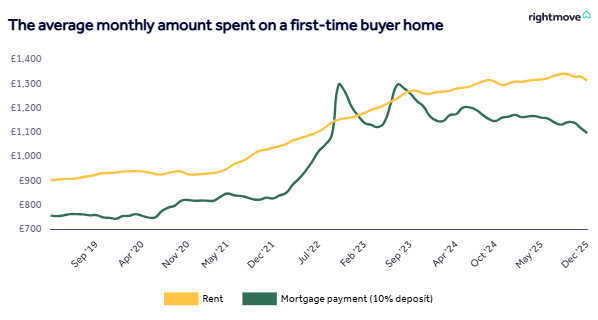

There’s excellent news forward. Mortgage charges proceed their downward pattern, with the typical two-year fastened mortgage price now at 4.33%, in comparison with 5.08% at the moment final yr. What’s extra, the enjoyable of mortgage lending standards and wage progress persevering with to run forward of inflation will assist affordability in 2026.

What do the specialists suppose?

Our property professional Colleen Babcock says: “Decrease pricing supported purchaser affordability and drove exercise within the first half of the yr, even after the April stamp obligation deadline in England. Within the second half of 2025, uncertainty brought on by rumours of property tax modifications in November’s Funds swirled, some from as early as August. This had an impression on pricing and exercise, as sellers needed to attempt to entice nervous consumers. The market will quickly profit from the standard enhance in home-moving exercise from Boxing Day. Rightmove’s Boxing Day Bounce is an annual occasion the place we see many start or resume their plans to maneuver after the distraction of Christmas. With the turkey and trimmings barely off the desk, annually we see folks heading straight to Rightmove to browse the recent listings on the market and picture how completely different subsequent Christmas may look.”

On the outlook, Colleen provides: “With market situations supporting larger ranges of exercise, and a hopefully extra sure financial surroundings, we forecast a greater yr for value progress in 2026 with a powerful rebound in exercise to kick begin the yr. Nevertheless, with purchaser selection remaining excessive, sellers will nonetheless want to come back to the market at tempting costs to draw consideration and do all that they will to make sure that their property is offered in addition to doable. A extra steady 2026 could be good for purchaser confidence, which in flip would additional enhance exercise ranges, resulting in a modest value improve.”

Matt Smith, our mortgage professional, provides: “We’re anticipating to finish the yr with a Financial institution Price reduce, which might be good for confidence heading into the Rightmove Boxing Day Bounce. It’s unlikely that it’s going to trigger a lot motion in mortgage charges – the markets are very a lot anticipating December’s reduce to go forward, and lenders have proven their hand early, slicing charges and competing to safe end-of-year enterprise. The headline is that home-movers can be coming into 2026 cheaper common mortgage charges than they have been at first of 2025, serving to affordability. Those that are seeing barely decrease home costs of their space in comparison with final yr and will have additionally had an end-of-year pay rise, will see their affordability improved additional. Many home-movers will even see that the quantity that they will borrow has elevated, as lenders have been rolling out the Mortgage-To-Revenue and stress price modifications that have been permitted by the regulator earlier this yr.”

What does 2026 appear like?

We are actually anticipating a bigger-than-usual Boxing Day bounce, as lots of those that paused their plans because of Funds uncertainty be a part of the standard begin of the busier home-moving season. There are already some very early indicators of a post-Funds market rebound in some segments. In London, the variety of new sellers coming to market on the top-end, which was hardest hit by Funds hypothesis, was up by 24% within the week after the Funds in contrast with the week earlier than.

The 2026 market can be extra just like the encouraging first half of this yr quite than the second half, the place confidence was affected by Funds hypothesis. Purchaser affordability is about to enhance, and the great selection of properties on the market continues to run at a decade-high degree. For these causes, we predict stronger housing market exercise and the typical value of properties coming in the marketplace to rise by 2% in 2026.

Regional variations can be noticeable. Scotland, Wales and northern England are anticipated to be extra resilient, with higher affordability and more healthy supply-demand steadiness supporting value progress. London and southern England are more likely to lag behind as they proceed adjusting to stamp obligation modifications and put together for the mansion tax on properties over £2 million from April 2028.

For sellers, the message stays the identical: value realistically from the beginning. With excessive ranges of selection obtainable and consumers within the driving seat, aggressive pricing can be important to draw consideration and safe a sale. The market is discovering its steadiness, and 2026 appears set to be a yr of modest progress constructed on improved affordability and renewed confidence.

How have asking costs modified over the previous 5 years?

How a lot are first-time consumers spending every month on common?

How lengthy does it take to discover a purchaser for a house on common?