The recent strengthening of the euro presents a significant challenge for the European Central Bank’s inflation strategy as officials prepare for their first policy decision of the year in Frankfurt. The currency’s rally risks driving euro-zone inflation even lower below the 2% target, prompting critical discussions among policymakers.

Although the ECB has maintained interest rates unchanged since June and no adjustments are anticipated on Thursday, several developments demand attention. Recent events include tensions with the Federal Reserve, fresh U.S. tariff proposals, and a sharp decline in the dollar. The dollar’s drop, influenced by U.S. President Donald Trump’s remarks downplaying its weakness, propelled the euro above $1.20 briefly, marking its highest level since 2021.

ECB leaders have taken note of these shifts. Bank of France Governor Francois Villeroy de Galhau emphasized that the euro serves as one of the key factors guiding monetary policy. Similarly, Austrian central-bank chief Martin Kocher indicated that officials will closely track the currency for any further appreciation.

Inflation Trends and Policy Implications

Euro-zone inflation already fell slightly below the 2% target in December, with projections pointing to 1.7% for January based on upcoming data releases on Wednesday. While the ECB anticipates price growth stabilizing at the target over the medium term without additional measures, a continued euro rise could reignite calls for further rate reductions.

Analysis from economic experts highlights growing downside risks to the outlook. Europe’s early-year geopolitical tensions, including U.S. trade disputes and the euro’s appreciation, suggest the ECB may prioritize broader trends over isolated events. These factors underscore vulnerabilities in the economic forecast, even as inflation dips modestly below target.

Global Central Bank Calendar

The ECB’s meeting coincides with rate decisions from about a dozen central banks worldwide. The Bank of England, Mexico, and the Czech Republic are expected to hold rates steady, while India and Poland may opt for cuts. Australia’s Reserve Bank of Australia could lead major institutions with a potential hike this year.

US and Canada

In the United States, January employment data will contrast with Federal Reserve assessments of a stabilizing labor market following slower hiring in late 2025. Economists forecast a payroll increase of 68,000 jobs—the strongest in four months—with the unemployment rate holding at 4.4%, just below November’s four-year high of 4.5%.

Potential delays in the jobs report loom due to a recent federal shutdown, though it is expected to be brief. The release will also include annual revisions, likely showing a record 911,000-job markdown for the year through March 2025. On Wednesday, U.S. central bankers maintained rates after three prior cuts, noting signs of labor market stabilization. President Trump, critical of the Fed’s pace on rate reductions, announced Friday the replacement of Chair Jerome Powell with former Governor Kevin Warsh, who has advocated for lower rates.

Additional U.S. labor indicators include December job openings and January employment indexes from the Institute for Supply Management’s surveys. The University of Michigan’s preliminary February consumer sentiment report on Friday will gauge views on the job market.

Turning to Canada, January jobs data are projected to reflect persistent labor weakness despite late-2025 gains. Unemployment stands at 6.8%, with elevated youth joblessness and subdued hiring intentions. Bank of Canada Governor Tiff Macklem, who recently stated that rules-based U.S. trade is over, will discuss economic shifts in a Toronto speech on Thursday.

Asia

Asia’s central banks may diverge in policy directions. Markets price in a higher likelihood of the Reserve Bank of Australia lifting its cash rate to 3.85% on Tuesday, driven by fourth-quarter inflation at 3.4%, exceeding the 2-3% target. India’s Reserve Bank faces pressure for a rate trim on Friday, as December consumer prices remained below the inflation midpoint for 11 months, bolstered by a strong harvest keeping food prices low.

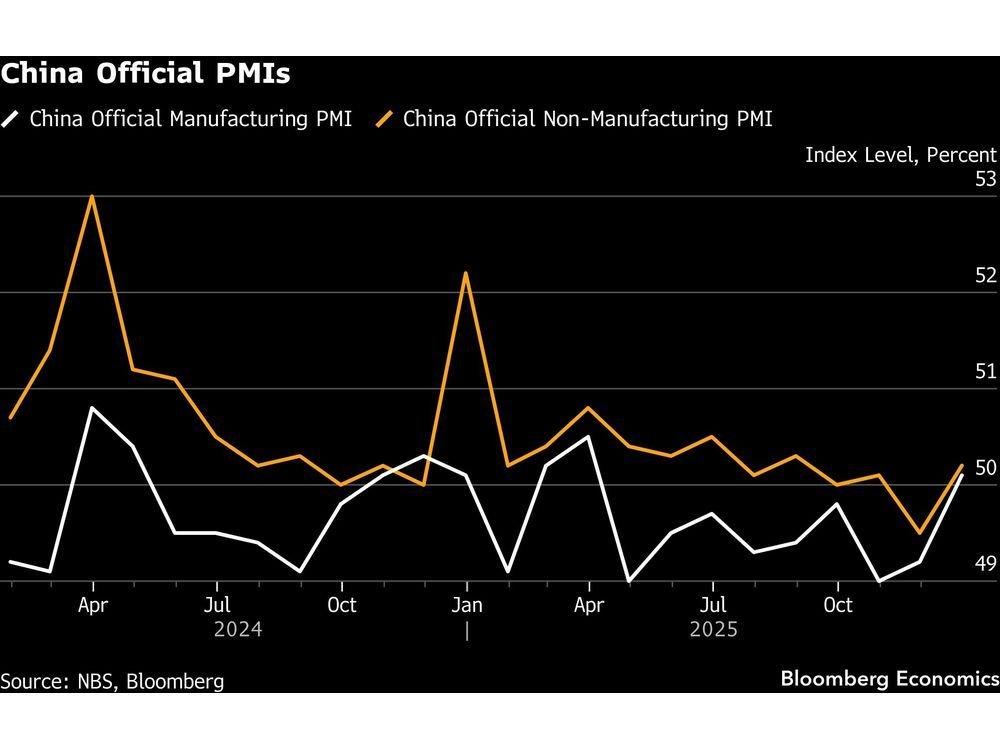

The Bank of Japan’s January meeting opinions summary, due Monday, could clarify the timing of the next rate hike. Manufacturing PMI reports on Monday from China, Indonesia, South Korea, and others are expected to show stability, with China’s at the expansion threshold of 50. New Zealand’s fourth-quarter labor data will spotlight an unemployment rate at 5.3%, a nine-year high. Inflation updates from Thailand, Taiwan, Vietnam, and South Korea follow midweek, alongside Japan’s Friday household spending figures amid upcoming elections. Trade data from Indonesia, Pakistan, and Australia round out the week.

Europe, Middle East, and Africa

The Bank of England is set to keep rates at 3.75% on Thursday, balancing rapid inflation cooling against persistent wage growth and economic strength. New forecasts predict inflation nearing the 2% target by spring, aided by recent budget measures. Czech policymakers will likely hold at 3.5%, while Poland may cut and Iceland pauses reductions until Q2. Other decisions involve Albania, Armenia, Madagascar, and Moldova.

Turkish inflation data on Tuesday should show a dip to around 30% in January from 30.9%, as the central bank eases rate cuts amid food price surges. Germany’s Thursday and Friday factory orders, production, and trade figures will assess recovery in Europe’s largest economy. Swedish inflation on Friday may ease slightly, but the Riksbank is expected to maintain its stance due to temporary factors and upside risks. Russia’s 2025 GDP data that day follows a forecast of 1% growth, down from 4.3% in 2024 amid reduced war spending.

Latin America

Brazil’s central bank minutes on Monday reiterate a hold on the Selic rate with guidance for a March cut, though details on the path remain limited. Industrial production and trade data follow. Chile’s December GDP proxy indicates rebound from weak November figures, supported by copper prices and peso strength curbing inflation; January prices may fall below 3%, with December minutes clarifying cut timing.

Mexico’s central bank signals a pause in its 400 basis-point easing cycle at Thursday’s decision, citing economic slack and U.S. trade uncertainties. Colombia faces inflation pressures, with Wednesday minutes explaining a surprise 100 basis-point hike to 10.25% due to wage increases. The quarterly policy report and Friday’s consumer prices data project headline inflation above 5.4% annually.