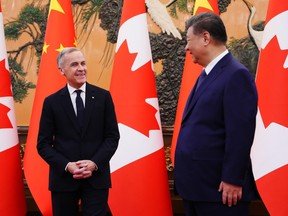

WASHINGTON, D.C. — Prime Minister Mark Carney’s recent trade agreement with China has sparked concerns in Washington and beyond, raising questions about whether the potential for expanded commerce justifies the dangers of exploitation and retaliation. Michael Kovrig, a former Canadian diplomat and China expert who endured nearly three years of wrongful detention in China, emphasizes that Beijing frequently employs economic and political pressure in its international relations.

Assessing the Pragmatic Yet Risky Deal

Kovrig describes the new Canada-China agreement as pragmatic but fraught with peril. When asked if the benefits of reduced trade barriers outweigh the risks of partnering with China, he responds succinctly: “No.” He explains that uncertainties abound, depending on how Canada navigates the agreement and how both China and the United States respond. “The Chinese Communist Party is a strategic and systemic rival to Western countries,” Kovrig states. “It actively seeks to undermine them and gain advantage, increasing other countries’ dependence on China while reducing its own.”

Any deal benefiting the CCP requires careful evaluation to ensure net gains for Canada. Otherwise, Kovrig warns, nations risk providing tools for their own strategic disadvantage.

Breaking Down the Canola-EV Exchange

The agreement partially restores market access for Canadian canola farmers, benefiting the economy and bolstering Liberal support in Western Canada. However, Kovrig cautions that this sector remains susceptible to future coercion. “If I were a betting man, I’d put money on China weaponizing that trade again one day,” he says. He urges diversification of production and markets to mitigate leverage, with annual progress checks.

The “strategic partnership” updates a 2005 accord and signals normalized diplomatic ties. Similar pacts exist with over 80 countries, including Canadian allies. The real dangers emerge if businesses interpret this as a green light for deeper engagement, expanding risks of interference and influence. “The more entwined Canada is with China, the greater the risks,” Kovrig notes, advocating for mitigation strategies.

Threats to the Automotive Industry

A major concern is the “gray rhino” risk to Canada’s auto sector. The deal trades immediate agricultural relief for potential vulnerabilities in manufacturing. While it caps EV imports and encourages local investment, benefits remain speculative without enforceable terms. “This is about managing danger, not building trust,” Kovrig asserts.

Initial EV entries from certified makers like Tesla and BYD will be limited, but consumer demand could erode quotas and price floors, outpacing domestic adaptation. Without strict local content rules or joint venture enforcement, imports may dominate, leading to deindustrialization. Kovrig highlights China’s overcapacity and export drive, predicting token assembly plants rather than robust ecosystems. “The end result is likely to be China dominating the market with imports,” he says.

From a security standpoint, such dependence could compromise Canada’s autonomy, especially amid U.S. tensions. “From a national security perspective, that’s insane,” Kovrig declares.

Geoeconomic and Long-Term Challenges

The deal could strain CUSMA negotiations and Canada-U.S. relations. Trading manufacturing strength for commodity exports risks alienating Washington, where allies are divided into aligned partners and hedgers. Kovrig questions Carney’s hedge against U.S. pressure: “What if this deal with Beijing just worsened the potential outcomes from negotiations with Washington?”

China’s industrial policies, including subsidies and dumping, accelerate global deindustrialization. Kovrig warns of a trajectory where Canada exports raw materials while relying on Chinese technology, eroding added value and industrial capacity. “Long term, does Canada want to be a carmaker or a gas station?” he asks. This path fosters political cycles favoring commodities, potentially leading to economic stagnation akin to Argentina’s experience.

Geopolitically, yielding to pressure on agriculture undermines deterrence against coercion, a tactic China employs worldwide. Success requires preserving innovation and productivity to maintain Canada’s top-10 global economy status.

Diversification and Safeguards

To avoid future coercion, Canada must draw red lines: automatic reversals for backtracking, sector exclusions, and refusals to trade silence for access. “Engagement without pre-set guardrails and exit ramps is not pragmatic diplomacy; it’s just deferred coercion,” Kovrig says. For EVs, binding requirements on investment and content are essential.

True diversification spreads trade across partners, deepens trusted ecosystems in Europe and Asia, and bolsters North American integration. In response to U.S. tariff threats, Canada should impose strict quotas, certifications, and assurances against backdoor access. “Any concession to Washington should reinforce continental integration, not weaken it,” Kovrig advises.

Defining Success

The deal succeeds if it avoids auto sector erosion, prevents retaliation, sustains supply-chain investments, and keeps relations transactional. “A boring relationship would constitute success: fewer trade shocks, steady canola exports without drama,” Kovrig concludes. Broader wins include honest power assessments, though losses involve concessions to authoritarian pressure.

Preventing “hostage diplomacy” demands resilience, ally coordination, and clear boundaries against intimidation, especially in politically charged disputes.