If Chase’s Pay Your self Again hasn’t been in your radar shortly, it might be value brushing up on this redemption possibility.

Not solely has the choice continued to increase to a broader checklist of Chase playing cards, however some redemption charges aren’t to be sneezed at.

Chase provides its Pay Your self Again profit on some cobranded bank cards, together with Southwest Airways playing cards, United Airways playing cards, the Aeroplan® Credit score Card (see charges and costs) and the Marriott Bonvoy Daring® Credit score Card (see charges and costs).

Many of those present provides are legitimate now by means of Sept. 30.

This is all the pieces it’s good to find out about utilizing Chase Pay Your self Again.

What’s Chase Pay Your self Again?

In 2020, when a lot of the world wasn’t touring, Chase launched Pay Your self Again as an ongoing redemption possibility inside its Final Rewards program to offer cardmembers a substitute for redeeming factors for journey. The classes have advanced over time, however the core objective of this system has remained just about unchanged.

In brief, the Pay Your self Again possibility permits cardholders of many Chase playing cards to make use of factors at a redemption worth much like reserving journey. This would possibly not sometimes provide the similar most worth on your Final Rewards factors that you could get with strategic use of switch companions.

Nonetheless, it could possibly be a sensible choice in the event you’re on the lookout for a easy redemption or have a pile of factors that you just can’t instantly use.

With some airline playing cards now eligible for Pay Your self Again, the speed at which you’ll redeem for some classes is over the typical return you may probably get when utilizing your rewards to e-book journey.

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: One of the best Chase bank cards

What purchases are eligible for Pay Your self Again?

Listed below are the present classes eligible for Pay Your self Again:

| Card | Redemption worth | Present finish date |

|---|---|---|

| Choose charities: 1.5 cents per level

Fuel stations, groceries, residence enchancment shops and cardholder annual price: 1.25 cents per level |

Sept. 30 | |

| Chase Sapphire Most well-liked® Card (see charges and costs) | Choose charities: 1.25 cents per level

Cardholder annual price: 1.1 cents per level |

Sept. 30 |

| Choose charities: 1.25 cents per level | Sept. 30 | |

| Choose charities: 1.25 cents per level | Sept. 30 | |

| Aeroplan Credit score Card | Journey purchases (as much as 200,000 factors or $2,500 yearly) and cardholder annual price (solely purchases made at choose retailers inside 90 days earlier than the redemption request date are eligible): 1.25 cents per level

Eating at eating places, grocery shops (excluding Goal, Walmart and wholesale golf equipment), residence enchancment shops, gasoline stations, choose shops and choose utilities: 0.8 cents per level |

Dec. 31 for residence enchancment shops, gasoline, choose shops and choose utilities (eating at eating places and grocery shops are ongoing classes) |

| United Airways private and enterprise bank cards | Cardholder annual price: 1.35-1.5 cents per mile (primarily based on which card you’ve got)

United airfare purchases made instantly with the airline of a minimum of $50: 1 cent per mile |

Dec. 31 |

| Southwest Airways private and enterprise bank cards | Cardholder annual price inside 90 days of transaction date: 1 cent per level | Sept. 30 |

| Marriott Bonvoy Daring Credit score Card | Journey purchases made instantly with airways or Marriott Bonvoy motels (as much as $750 complete per yr): 1 cent per level | Ongoing perk of the cardboard |

| Disney bank cards | Purchases made at choose U.S. Disney areas in Disney Parks and Resorts, Disney retailer and outlet areas within the U.S., shopDisney.com, DisneyPlus.com, Hulu.com and ESPNPlus.com up to now 90 days: 1 Disney Rewards Greenback per greenback

These with a Disney® Premier Visa® Card (see charges and costs) can redeem Disney Rewards {Dollars} towards airline purchases with any airline on the fee of 1 Disney Rewards Greenback per greenback |

Ongoing; no particular finish date |

The data for the Chase Freedom Flex, Chase Freedom card and J.P. Morgan Reserve Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

The checklist of charities for Pay Your self Again contains:

- American Pink Cross

- Equal Justice Initiatives

- Feeding America

- GLSEN

- Habitat for Humanity

- Worldwide Medical Corps

- Worldwide Rescue Committee

- Management Convention Schooling Fund

- Make-A-Want America

- NAACP Authorized Protection and Schooling Fund

- Nationwide City League

- Out and Equal Office Advocates

- SAGE

- Thurgood Marshall School Fund

- United Negro School Fund

- UNICEF USA

- United Means

- World Central Kitchen

As an instance you wished to redeem 10,000 factors in your Chase Sapphire Reserve. For many purchases, you may get a $100 assertion credit score when redeeming 10,000 factors.

However for those self same 10,000 factors, you may get a credit score of $150 if you redeem them for an eligible charity donation.

Associated: How a lot are Chase Final Rewards factors value?

Requesting a credit score

Requesting a credit score by means of Chase’s Pay Your self Again program is comparatively simple. Log in to your eligible Chase account through the cell app or desktop and choose the “Pay Your self Again” possibility within the redemption menu.

Subsequent, you may see a listing of eligible purchases for which you’ll redeem factors. Factors might be redeemed for purchases way back to 90 days.

You’ll be able to offset the total buy quantity, assuming you’ve got sufficient factors to cowl it.

From there, you may verify the redemption worth and quantity of factors required after which select to finish the transaction. Your assertion credit score ought to publish inside three enterprise days.

Associated: Tips on how to use Store By Chase to earn extra factors

Assertion credit score choices on different purchases

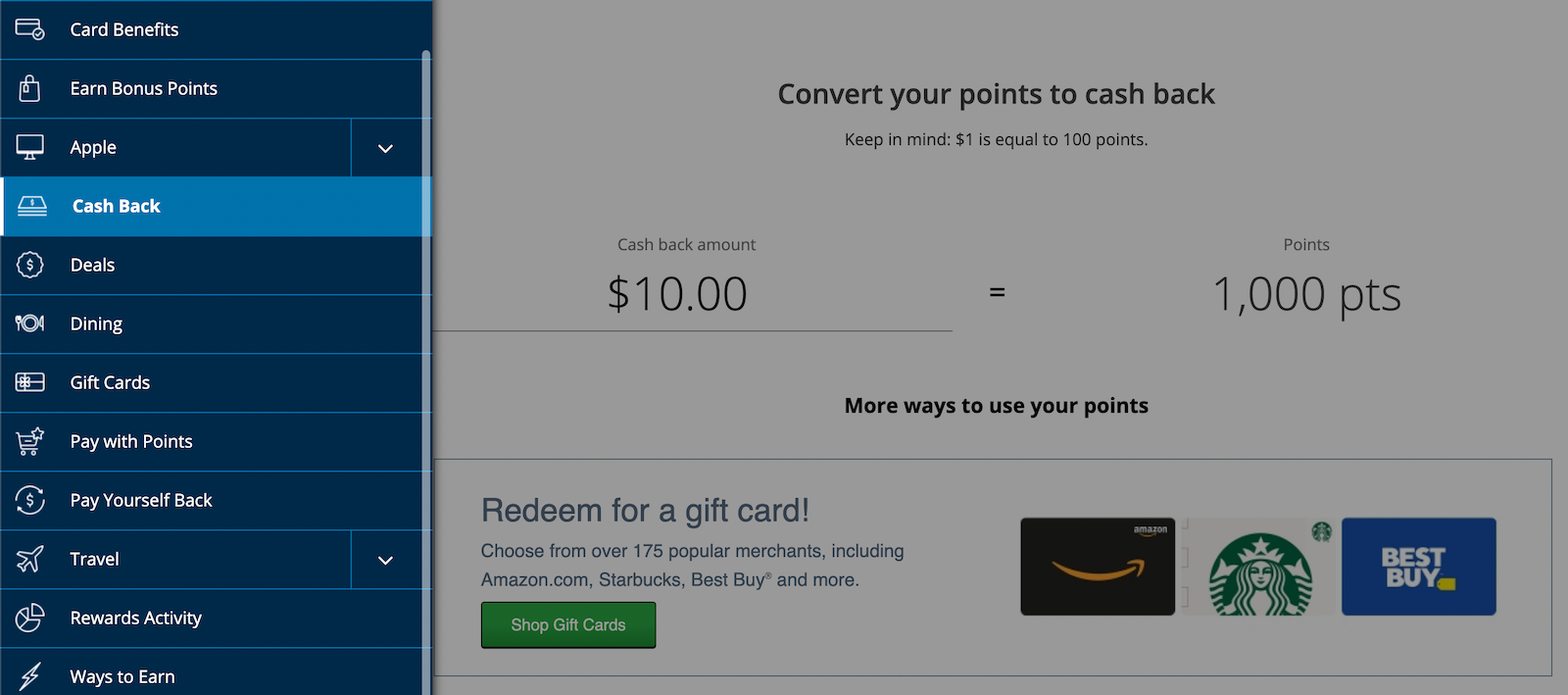

Chase has lengthy supplied the choice to redeem factors for a press release credit score — that is not new. To do that, log into your Final Rewards account, hit the drop-down menu and choose “Money Again.”

You may be given an choice to enter the quantity you’d prefer to redeem and the place you want your rewards deposited. All cash-back redemptions are fastened at 1 cent per level, rather less than half of TPG’s July 2025 valuation of Final Rewards at 2.05 cents per level.

That redemption worth can be decrease than most of the above Pay Your self Again choices.

Even so, Chase’s conventional cash-back possibility is extra beneficiant than what you may count on from another issuers. You may get the identical worth when redeeming Citi ThankYou factors for money again, however Amex solely provides 0.6 cents per level for this selection. Capital One is available in final place, with cardholders netting simply 0.5 cents per mile when redeeming for money again.

Associated: If I money out my factors and miles, do I’ve to say it on my taxes?

Backside line

Chase’s Pay Your self Again characteristic supplies precious flexibility for a lot of cardholders. In the end, whether or not it’s best to redeem your steadiness on this means relies on how you propose to make use of your factors, what number of you presently have and whether or not or not you’d profit considerably from the assertion credit.

Associated: Supercharge your Chase Final Rewards steadiness with these prime 5 playing cards