Submitting taxes is all the time prime of thoughts at the start of the 12 months, however even after April has come and gone, the cash you and your homeowners can save by deductions ought to all the time be in your radar.

No-Fuss Financials

Automated bookkeeping to simplify accounting a develop your small business.

Be taught Extra

Small modifications to your tax submitting technique can truly result in important price financial savings in only a quick time frame. Understanding about the correct deductions (and the correct instruments to report them simply) may help you retain cash in your pocket (and prevent hours of time).

Bonus depreciation is one such deduction that may cut back your tax burden considerably and instantly, slightly than supplying you with smaller advantages over time.

Let’s check out what bonus depreciation truly means for property managers, what qualifies for a deduction, and the best solution to begin saving.

What Is Depreciation in Actual Property?

Depreciation is without doubt one of the main the explanation why people select to put money into actual property. Within the eyes of the IRS, many belongings, together with rental properties, depreciate over time because of put on and tear, together with different components. Due to that, you possibly can write off the price of the property over the course of its “helpful life” (27.5 years within the case of a residential rental property).

Property homeowners can get much more profit from these deductions by price segregation. A licensed price segregation specialist can conduct a price segregation research on a property that identifies its totally different components—like roofing, home windows, and flooring—and offers an accelerated depreciation timeline for every.

How does this profit you as a property supervisor? That’s the place bonus depreciation kicks in.

What Is Actual Property Bonus Depreciation?

Bonus depreciation is an IRS tax code that lets you depreciate the worth of sure belongings that make up a rental property extra rapidly than regular. As a substitute of getting a tax write off over the helpful lifetime of a property, you’ll be capable to get a bigger deduction within the first 12 months the asset was positioned in service.

By depreciating the price of eligible belongings up entrance, you possibly can liberate money circulate, cut back the tax legal responsibility for your small business, and presumably even qualify for a decrease tax bracket.

Right here’s the way it works: If you buy a brand new piece of property or make enhancements to current property, you possibly can depreciate the fee over a time frame. Below the bonus depreciation rule, you possibly can take an extra deduction of 100% of the price of eligible belongings within the first 12 months of possession. That may end up in important tax financial savings.

You may even use bonus depreciation to create a internet working loss, which you’ll be able to carry ahead to offset future revenue.

What Property Managers Ought to Find out about Bonus Depreciation

Earlier than leaping into the specifics of how you can file for deductions utilizing bonus depreciation, you must know which belongings qualify and the constraints round sure asset instances.

Listed here are the kinds of purchases and enhancements eligible for bonus depreciation that each property homeowners and property managers ought to know.

Certified Property for Bonus Depreciation

Property that qualifies for bonus depreciation should have a helpful lifetime of between one and 20 years.

However wait, we simply stated that residential rental property has a helpful lifetime of 27.5 years.

A residential rental property itself doesn’t qualify. However there are a number of different asset varieties you can declare bonus depreciation on. These fall into two fundamental classes: private property and land enhancements.

Private Property and Bonus Depreciation

You may deduct any tangible property that you just’ve bought for enterprise use, together with use inside a rental property. This could embrace each new and newly acquired used property, as long as the proprietor hasn’t personally used the merchandise earlier than putting it within the rental.

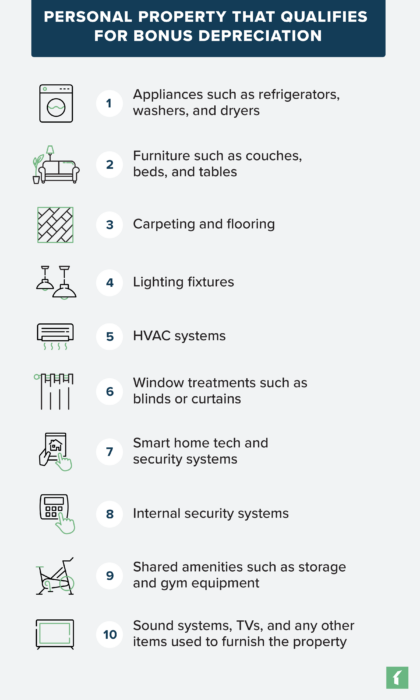

The record of private property that qualifies for bonus depreciation is in depth, however a few of the most typical gadgets embrace:

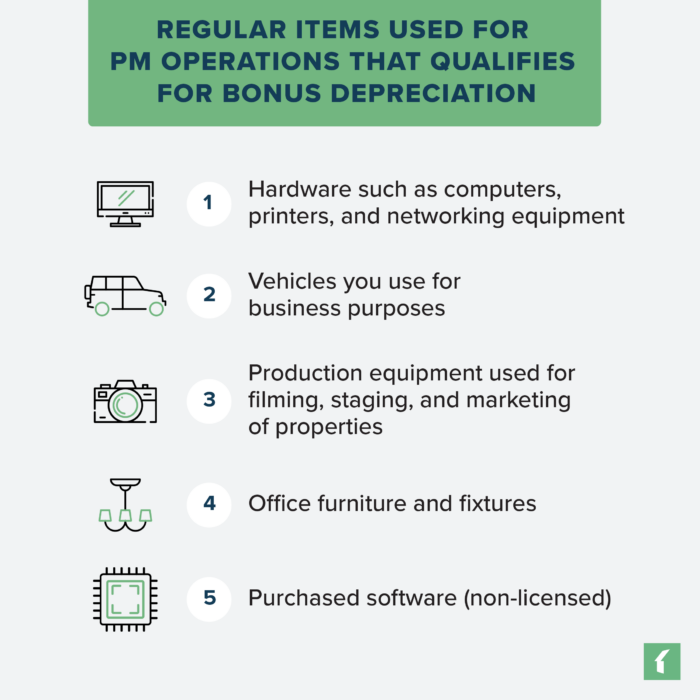

Gadgets you employ to your common property administration operations additionally qualify for bonus depreciation. Listed here are some examples:

Land Enhancements and Bonus Depreciation

That is the place issues get a bit tough. Whereas the land a property sits on doesn’t qualify for traditional depreciation underneath tax regulation, land enhancements which have a 15-year helpful life (a.okay.a a restoration interval) do qualify for bonus depreciation. These can embrace upgrades or work executed to the next outside belongings:

Rental Property Bonus Depreciation vs. Part 179

Many traders are unclear concerning the variations between bonus depreciation and Part 179 of the Inside Income Code (IRC).

Whereas each kinds of incentives let you take upfront deductions on the acquisition value of apparatus, bonus depreciation has fewer limitations. Most significantly, there is no such thing as a restrict to the annual revenue of a enterprise to qualify for bonus depreciation—versus Part 179—so you possibly can nonetheless declare a deduction and carry it ahead, even in case you’re recording a internet loss for that 12 months.

The primary advantage of Part 179 over bonus depreciation is that it presents larger flexibility. You may decide and select which belongings and the way a lot of the price of every asset you’d wish to cowl, saving the remainder for future tax breaks. However understand that the utmost deduction underneath Part 179 is $1,160,000 as of the 2024 tax 12 months.

Neither choice is a one-size-fits all answer, and you may truly mix bonus depreciation with Part 179. To try this it’s important to apply Part 179 choosing the belongings and share of protection you need. Any deduction quantity over the Part 179 restrict is then eligible to be acquired by bonus depreciation.

Electing Out of Bonus Depreciation

If you wish to change course and choose out of bonus depreciation for an asset already elected for bonus depreciation, you’ll must affirmatively elect out. That entails attaching an announcement to a well timed filed return for every asset, indicating the kind of election (on this case, bonus depreciation, or just bonus) and the helpful life interval, or asset class.

You’ll must elect out individually for every asset class with a separate assertion (i.e. a 5-year asset class, a 7-year asset class, and so on.). Right here’s an instance of 1 such assertion:

“Taxpayer hereby elects out of bonus for tax 12 months 2022 for its 10-year and 15-year asset lessons.”

Electing out late or trying to revoke an election you’ve made could be a time-consuming course of with further types concerned and with none assure of success. Be correct and positive of your resolution earlier than making the selection to elect out.

How one can Calculate Bonus Depreciation

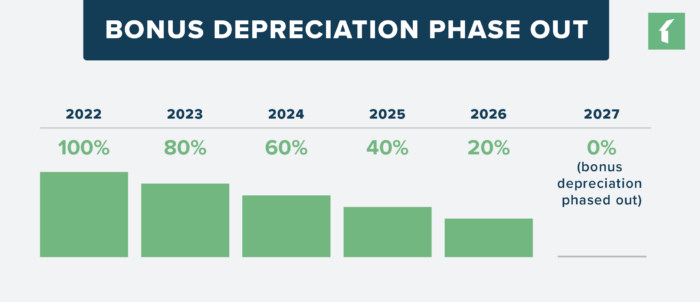

As outlined within the 2017 Tax and Jobs Act, eligible property might origninall be deducted at 100% of the fee. That share has modified and can proceed to vary within the subsequent tax years, nevertheless. Within the 2024 tax 12 months, the speed for bonus depreciation will likely be lowered to 60%. That fee will likely be lowered additional to 40% in 2025, and 20% in 2026. Bonus depreciation will lastly be phased out within the 2027 tax 12 months.

With these charges in thoughts, step one is to survey your rental property for eligible belongings. Solely a licensed skilled can conduct the on-site price segregation survey essential to determine the parts of a rental property that qualify for bonus depreciation.

Whereas it might look like a whole lot of work, the upfront price and energy are sometimes dwarfed by the financial savings bonus depreciation can convey. That’s very true in case you’re managing a bigger portfolio of properties or in case you’re managing bigger, multifamily properties on the whole.

The advantages of tax financial savings from getting into a decrease tax bracket or carrying ahead deductions within the occasion of a internet working loss are laborious to overstate.

Is There Bonus Depreciation Software program That Can Assist?

At this level, you could be in search of methods to reduce your effort whereas nonetheless getting all the advantages of bonus depreciation. There isn’t software program that may instantly calculate bonus depreciation for rental properties (you’ll must undergo a licensed skilled for that), however there are easy-to-use instruments that may simplify your total property administration accounting course of.

The most effective half? Instruments might already be at your disposal in case you’re utilizing property administration software program for the remainder of your operations.

Buildium, for instance, comes outfitted with an entire suite of accounting instruments that automate accounting and assist you to reconcile your books with pinpoint accuracy.

As a result of Buildium additionally helps you handle your small business as an entire, accounting options join seamlessly with hire funds, messaging, and reporting instruments, saving you much more time. This implies you’ll be capable to create and share reviews in just some clicks, utilizing numbers you possibly can belief.

If you happen to’re able to simplify property administration accounting, take a peek at our options and take Buildium for a spin with a free, 14-day trial—no bank card required.

Continuously Requested Questions

What’s bonus depreciation and the way does it work?

Bonus depreciation permits property managers to deduct a bigger portion of the price of a property within the 12 months it was bought, slightly than spreading the deduction over a number of years. This could considerably cut back taxable revenue, making it a pretty choice for property managers trying to maximize their tax financial savings.

Which properties qualify for bonus depreciation?

A variety of things used for property administration operations, private property, and land enhancements qualify for bonus depreciation. This may increasingly embrace gadgets corresponding to home equipment, carpeting, and landscaping, to call just a few. For a extra detailed record, take a look at the sooner sections of this put up.

Are there any limitations on bonus depreciation?

Whereas bonus depreciation presents nice advantages, it solely applies to new properties or these new to you because the property supervisor. It doesn’t apply to properties you may have already owned and used. Keep knowledgeable about any modifications to tax legal guidelines which may have an effect on this.

How do I declare bonus depreciation on my taxes?

To say bonus depreciation, fill out Type 4562 when submitting your tax return. Ensure that to maintain thorough data of all property purchases and enhancements to assist your claims. All the time double-check the newest IRS pointers or seek the advice of with a tax skilled.

Can I mix bonus depreciation with different tax advantages?

Sure, property managers can mix bonus depreciation with different tax advantages corresponding to Part 179 expensing. Nonetheless, it’s essential to grasp the precise guidelines and limitations of every to maximise your tax advantages successfully.

Is bonus depreciation obtainable yearly?

The provision and share charges for bonus depreciation can change primarily based on tax legal guidelines. Below the bonus depreciation rule, you possibly can take an extra deduction of 100% of the price of eligible belongings within the first 12 months of possession.

Learn extra on Accounting & Reporting