Some of the essential accounting practices in any enterprise is establishing and holding a property administration chart of accounts. As a property supervisor, your chart of accounts will aid you hold tabs on each transaction for every of your properties in your portfolio.

Featured Useful resource

Chart of Accounts

Need clearer, cleaner books? What a few extra helpful view into your properties or simply simpler accounting generally?

Get the Information

“Having a transparent, concise chart of accounts is essential on your purchasers to know how their rental properties are performing,” says Taylor Brugna, Associate at The Actual Property CPA. “It will possibly information future investments and assist each you and your purchasers make essential monetary selections.”

On this article, we’ll stroll by establishing a chart of accounts on your rental properties and focus on some greatest practices, with the assistance of Brugna. You may even obtain our free information above to get began.

What Is a Property Administration Chart of Accounts?

Brugna describes a property administration chart of accounts as a file that organizes every transaction made on your properties into accounting classes. These classes supply a transparent understanding of knowledge related to every property. Transactions fall underneath one among 5 overarching classes: belongings, liabilities, bills, earnings, or fairness. Every property will get its personal coding system inside your chart of accounts. Put collectively, all of these accounts turn into your chart of accounts.

Belongings

- Definition: Objects of worth that the enterprise owns or controls, you can count on to offer monetary profit on your firm sooner or later, similar to properties which may be eligible for tax benefits just like the bonus depreciation deduction, which has been reset to 100% underneath the One Large Stunning Invoice Act.

- Examples: Checking accounts, financial savings accounts, and gathered depreciation of every property

Liabilities

- Definition: Quantities owed to different events, similar to loans for property acquisition, excellent payments, or safety deposits held for tenants

- Instance Classes: refundable safety deposits, bank card balances, and taxes/insurance coverage owed on properties.

Revenue

- Definition: The cash your online business earns from operations and different actions. These classes present perception into the sources of income for your online business, and it is very important file them accurately for tax functions. For instance, the IRS states that advance hire funds, like for a lease’s last yr, should be included in your rental earnings within the yr they’re acquired.

- Instance Classes: Administration charges, onboarding charges, leasing charges, late fee charges, upkeep markups

Bills

- Definition: The cash flowing out of your online business, together with the prices affiliation together with your operations and administration actions. This could embrace car bills, for which the IRS set the 2024 commonplace mileage fee at 67 cents per mile.

- Instance classes: overhead, payroll, insurance coverage and licensing, contractor charges, service charges, authorized charges

Fairness

- Definition:Merely put, the cash that you’ve invested in your online business after deducting what’s owed to different events (liabilities and bills)

- Instance classes: web earnings, retained earnings, and any contributions or distributions made on your properties

The codes can get fairly granular, however that’s a very good factor. By giving every transaction a selected code, you may simply monitor the place each penny goes and which properties are worthwhile.

Key account examples:

- Belongings: Checking accounts, financial savings accounts, gathered property depreciation

- Liabilities: Safety deposits, bank card balances, taxes and insurance coverage payable

- Fairness: Internet earnings, retained earnings, property contributions and distributions

Why Do You Want a Chart of Accounts for Your Property Administration Firm?

Within the days earlier than computer systems, every transaction had its personal web page in a ledger ebook, recording earnings, bills, belongings, liabilities, and fairness. Transactions had been recorded and, on the backside of the web page, the numbers had been tallied. To get a complete image of income and losses, an accountant merely had so as to add up earnings, belongings, and fairness, after which subtract bills and liabilities.

A property administration chart of accounts is the spine of all of the monetary experiences and forecasting you do for each your organization and your properties. It permits you to:

- Report the monetary well being of rental properties to house owners

- Decide hire and charge will increase

- Forecast advertising, staffing, and different budgets

- Report correct financials for taxes

Methods to Set Up a Chart of Accounts for Your Property Administration Portfolio

A chart of accounts for property administration is about up in a hierarchy of entries. You may even consider it by way of a parent-child group. The very best-level entries can be the 5 we mentioned above. Then, every of your transactions can be grouped as “kids” beneath.

Step 1: Assign Mother or father Class Codes

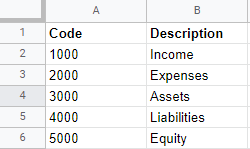

Many consultants suggest numbering line gadgets utilizing ranges of 1,000. For instance, belongings can be assigned the high-level quantity 1000, and all belongings can be coded between 1000 and 1999. In line with Brugna, a typical numbering system can be organized as follows:

- Belongings: 1000-1999

- Liabilities: 2000-2999

- Shareholder’s Fairness: 3000-3999

- Income: 4000-4999

- Bills: 5000-5999

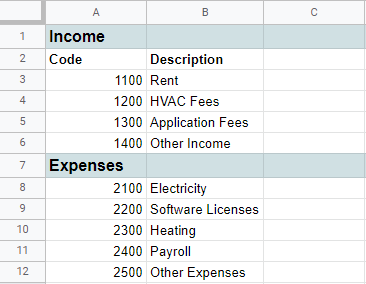

Step 2: Assign Baby Class Codes

Below that, you may assign several types of earnings their very own numbers. For instance, 1100 is likely to be hire, whereas 1200 could possibly be HVAC upkeep charges.

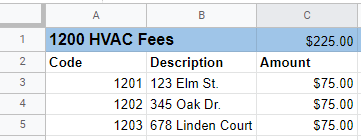

Step 3: Assign Property Codes

Lastly, you’ll want a approach to establish which earnings comes from which property, whereas leaving room so as to add future properties.

To try this, assign every property a quantity within the 1s place of your accounts. So, your property at 123 Elm St. can be assigned 1101 for hire and 1201 for HVAC charges. For different accounts, it could nonetheless be assigned a one within the 1s place.

To maintain line gadgets straight, be sure that every has a transparent and temporary abstract.

Property Administration Chart of Accounts Examples

Let’s check out how the above instance would look on a spreadsheet.

On the highest degree, you chart of accounts will look one thing like this:

Below these high-level classes, you’ll then fill in every line merchandise description:

Lastly, transactions for every property can be recorded utilizing codes based mostly on the descriptions you already arrange:

If performed utilizing a easy spreadsheet, a chart of accounts can take a while to arrange. You’ll have to trace down each transaction that goes by your property administration agency, create a coding system that works greatest on your firm, after which arrange the sheets. Placing within the time to create a constant accounting technique that makes including new transactions straightforward, nonetheless, is properly price it.

If the concept of updating a spreadsheet is unappealing, there are, after all, software program options that automate accounting processes and hold your books rather more safe than a spreadsheet ever would.

Quickbooks for a Property Administration Chart of Accounts

Quickbooks in all probability involves thoughts on your personal enterprise’ financials. This versatile software program consists of templates that work for many companies, and it may be built-in with different instruments. When you’re utilizing a property administration software program resolution with an open API, you may combine QuickBooks instantly into that device.

It’s essential to remember, nonetheless, that QuickBooks auto-populates their charts of accounts and is greatest suited on your inner firm financials versus accounting for the properties you handle. You will have to spend a while tweaking it to fulfill the wants of a property administration firm.

Utilizing Buildium for a Property Administration Chart of Accounts

In terms of dealing with the accounting on your house owners’ properties, a strong property administration resolution, nonetheless, may have accounting instruments constructed proper in, with templates which can be already configured for these wants. Buildium comes with an ordinary chart of accounts for rental properties together with the choice to edit an current common ledger account.

The chart of accounts view within Buildium’s property administration software program.

Utilizing Buildium, you may arrange accounting to file each transaction on the unit degree. That is notably useful for properties with bigger properties that include a number of models. There are a couple of essential advantages to having this degree of element in your chart of accounts:

- You’ll be capable of monitor the monetary well being of each lease inside every of your properties.

- Transactions tied to particular models are robotically mirrored on several types of funds, similar to hire deposit examine, printed checks, and EFT funds.

- Buildium reveals a extra granular breakdown of administration charges by unit.

- You may create and share particular person experiences or report batches, together with Revenue Statements, Rental Proprietor Statements, and Basic Ledger Consolidation Studies, all with unit-level particulars.

Wish to see these options in motion? You may schedule a guided demo to study extra about how Buildium can streamline your property administration accounting.

Property Administration Chart of Accounts Finest Practices

When you get your chart of accounts up and working, arrange a coaching session with stakeholders, explaining the coding system. Educate them to stick to the next greatest practices, as properly.

#1: Designate One Individual to Replace the Property Administration Chart of Accounts

A property administration chart of accounts is certainly a cooks-in-the-kitchen state of affairs. Too many individuals accessing the file will solely trigger errors and chaos—and by too many, we imply multiple.

#2: Replace Regularly and Persistently

Get your staff on a daily schedule of reporting transactions to you or the particular person accountable for the property administration chart of accounts. Give them a deadline to get all of their transactions in. That method, there’s time to replace and reconcile by the tip of the month.

#3: Follow Your Coding System

In fact, you’ll have to add new line gadgets for brand new transactions, however every new merchandise must be sorted into current classes that observe the coding system you arrange.

“Consistency in categorizing will assist your property house owners establish developments, areas of success, and the place to enhance,” says Brugna. “For instance, monitoring repairs and upkeep prices month over month offers you a transparent breakdown of bills and present you the way renovation budgets are monitoring.”

#4: Report Completely Every part

Don’t hold something off the books, and even in a separate chart of accounts. Report each single transaction in the identical place. Taxes, compliance, property forecasting, and funding selections all rely on a whole image of your properties’ funds.

#5: Maintain the Miscellaneous Objects to a Minimal

When you’ve ever moved, you all the time find yourself with that one field of miscellaneous stuff you don’t know what to do with. While you unpack it, you’re left with a large number of random issues to take care of.

The identical goes on your property administration chart of accounts. Whereas you could have some miscellaneous earnings or bills, you shouldn’t use that class as a catch-all for transactions you simply don’t wish to take care of for the time being. You’ll find yourself with a large number that will likely be robust to reconcile on the finish of the month, quarter, or yr.

Set Up and Preserve Your Chart of Accounts with Ease

A chart of accounts is a must have device for any profitable property administration enterprise. Whether or not you retain a spreadsheet, use a one-size-fits-all program similar to Quickbooks, or go for specialised accounting instruments from a property administration software program resolution, select the tactic and the system that works greatest for you and stick with it.

Need extra insights to deepen your understanding of the Chart of Accounts? Try our step-by-step information, Setting Up an Efficient Chart of Accounts. It even features a template that will help you get began.

For a extra in-depth have a look at a property administration chart of accounts, you may take a look at the on-demand video beneath for an concept of how property managers can use know-how to assist, as properly.

To study extra about Buildium’s accounting instruments, join a 14-day free trial, no bank card required, or schedule a demo.

Regularly Requested Questions About Property Administration Chart of Accounts

What’s a chart of accounts?

A chart of accounts is a listing of all of the monetary accounts utilized by a property administration enterprise. It organizes revenues, bills, belongings, and liabilities, serving to you retain monitor of monetary transactions and perceive your online business’s monetary well being.

Why is a chart of accounts essential for property administration?

A well-organized chart of accounts helps property managers categorize and file monetary transactions precisely. This observe simplifies monetary reporting, aids in budgeting, and permits for higher monetary evaluation, making it simpler to handle properties effectively.

How do I begin establishing a chart of accounts?

Start by itemizing all of the accounts you want, grouped into classes similar to earnings, bills, belongings, and liabilities. Be particular and detailed, together with accounts for hire, upkeep prices, utilities, and property taxes. Use accounting software program similar to Buildium, if potential, to streamline the method.

What are the 5 predominant sorts of accounts in a property administration chart of accounts?

The 5 predominant account varieties are Belongings (what the enterprise owns, like financial institution accounts), Liabilities (what’s owed, like safety deposits), Fairness (the web price of the enterprise), Revenue (income from hire and costs), and Bills (prices of operation, similar to repairs and utilities).

How is a property administration chart of accounts totally different from a common enterprise one?

It’s specialised for property-specific accounts like rental earnings, safety deposits, and per-property monitoring—options that common enterprise accounting doesn’t require.

Can I customise my chart of accounts in property administration software program?

Sure. Whereas platforms similar to Buildium include an ordinary, industry-specific chart of accounts to get you began, you may customise it to suit your enterprise. You may add, edit, or deactivate accounts to ensure the construction completely matches how you use and report back to house owners.

Evaluate it yearly and at any time when your online business modifications, similar to including new property varieties or companies.

Learn extra on Accounting & Reporting