[ad_1]

Key takeaways

- The housing market has made a optimistic begin to 2026, with a report January worth bounce and robust purchaser demand

- The typical new vendor asking worth is £368,031 – that’s 2.8% increased than in December and 0.5% up on final yr.

- Purchaser demand rose 57% within the two weeks after Christmas, in contrast with the 2 weeks earlier than.

- The variety of properties listed on the market on Rightmove elevated by 81% within the two weeks after Christmas.

- The 2-year common mounted mortgage price* is 4.29%, down from 5.03% final yr.

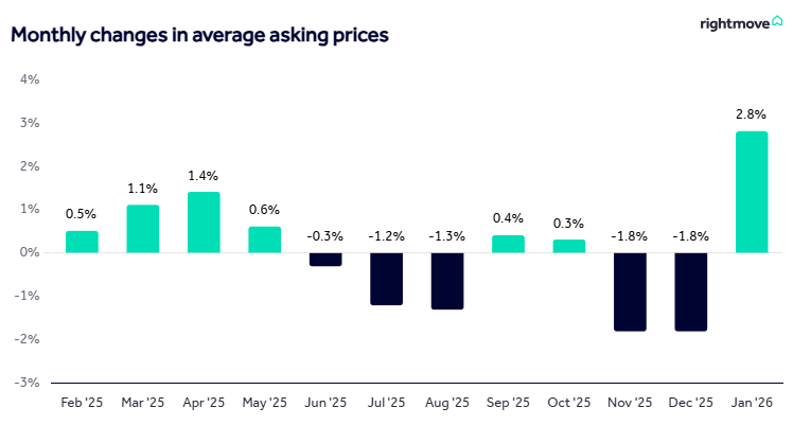

Asking costs are up 2.8% month-on-month in January 2026 – the biggest improve seen within the month of January on report, in line with our newest home worth knowledge

Nationwide market overview

January home worth figures point out an lively market, suggesting many people are already exploring our choices for a transfer in 2026. The typical worth of properties listed on the market rose to £368,031 in January 2026, up 2.8% from December 2025 (+£9,893). It’s the biggest worth improve on report for the month of January, and the biggest rise for any month since June 2015.

This bounce brings common asking costs near the place they had been in August 2025, with the market having recovered from the uncertainty that surrounded the November Funds. Nationwide property costs are actually barely increased than this time final yr (+0.5%).

The January rise additionally follows Rightmove’s busiest ever Boxing Day for visits to the platform, leaping 93% in contrast with Christmas Day. Within the 5 days after Christmas, purchaser enquiries additionally rose 67% in comparison with the 5 days earlier than, whereas new listings elevated by 143%.

What does this imply for sellers?

The current uptick in property costs means that vendor confidence is excessive. Nonetheless, new sellers ought to hearken to the steering of their brokers on the subject of pricing, and keep away from getting carried away with the brand new yr enthusiasm.

The variety of properties listed on the market has elevated by 81% within the two weeks after Christmas in contrast with the 2 weeks earlier than, making the variety of properties out there on the market now the very best it’s been presently of yr since 2014.

Potential patrons have lots of alternative proper now, and a 3rd of current properties on the market have diminished their unique asking worth. So, in the event you’re considering of promoting, it’s best to look to strike a stability between worth ambition and market realism when setting your asking worth, to have the very best probability of discovering a purchaser and getting your private home bought.

What does this imply for patrons?

This time final yr we noticed a flurry of patrons trying to full their purchases earlier than the April stamp responsibility rise in England. Whereas this makes year-on-year comparisons much less helpful, present figures for purchaser demand in January are largely consistent with 2024 ranges.

It’s an encouraging early snapshot, with purchaser demand having elevated 57% within the two weeks after Christmas in contrast with the 2 weeks earlier than. Because the yr progresses, it’s going to change into clear if this momentum could be maintained into the height Spring promoting season.

Many patrons, and notably first-time patrons, might be holding a eager eye on current worth will increase. Nonetheless, asking costs are solely again to the place they had been in the summertime of 2025 earlier than the Funds rumours started surfacing, which unsettled the market and dented confidence.

Nationwide and sector breakdown

| Market section | Avg. Value | MoM Change | YoY change |

|---|---|---|---|

| General | £368,031 | +2.8% | +0.5% |

| First-time patrons | £225,544 | +1.6% | -0.7% |

| Second-steppers | £341,131 | +2.0% | +0.5% |

| Prime of the ladder | £658,658 | +2.6% | +0.5% |

Regional traits

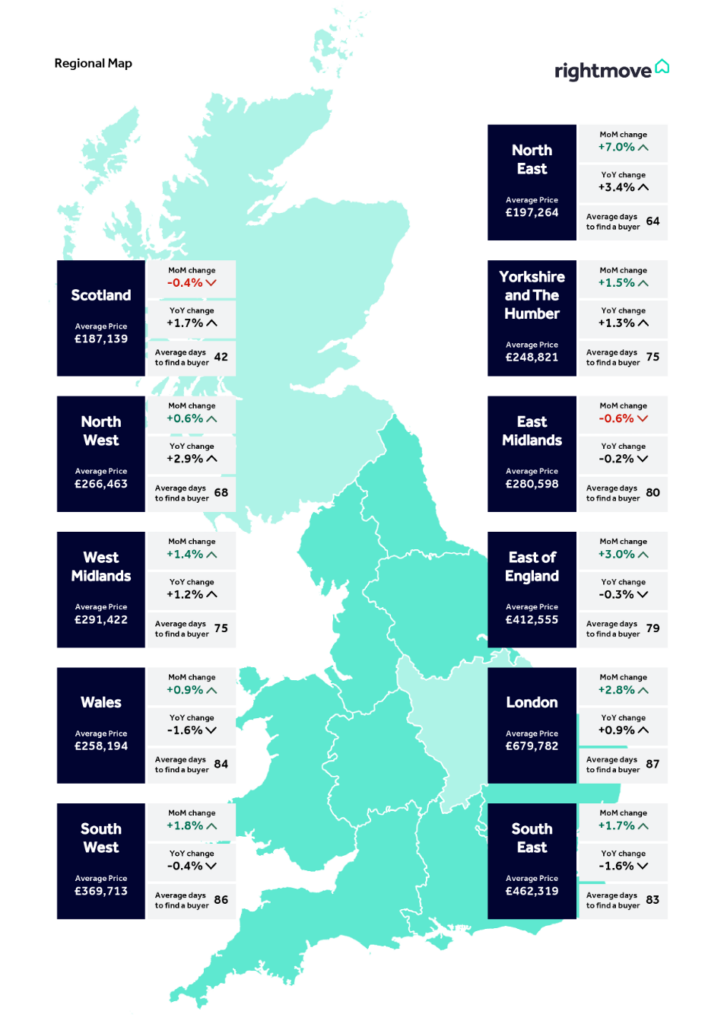

Whereas January’s restoration brings common asking costs near the place they had been in August 2025, worth traits in areas and native markets throughout Nice Britain present better variance.

Whereas most areas noticed a month-to-month improve in property costs in January 2026, a number of areas such because the South East and East of England have seen a drop in common property costs versus this time final yr.

| Area | Annual change | Notes |

|---|---|---|

| London | +0.9% | The capital is performing strongly, pushed by a +2.8% month-to-month improve |

| North East | +3.4% | Largest annual worth improve for any area, pushed by a +7.0% month-to-month improve |

| East of England | -0.3% | Annual worth fall regardless of a +3.0% month-to-month improve |

| South East | -1.6% | Joint largest annual fall, regardless of a +1.7% month-to-month improve |

| Scotland | +1.7% | Annual worth rise regardless of a -0.4% month-to-month lower |

What’s taking place with mortgage charges?

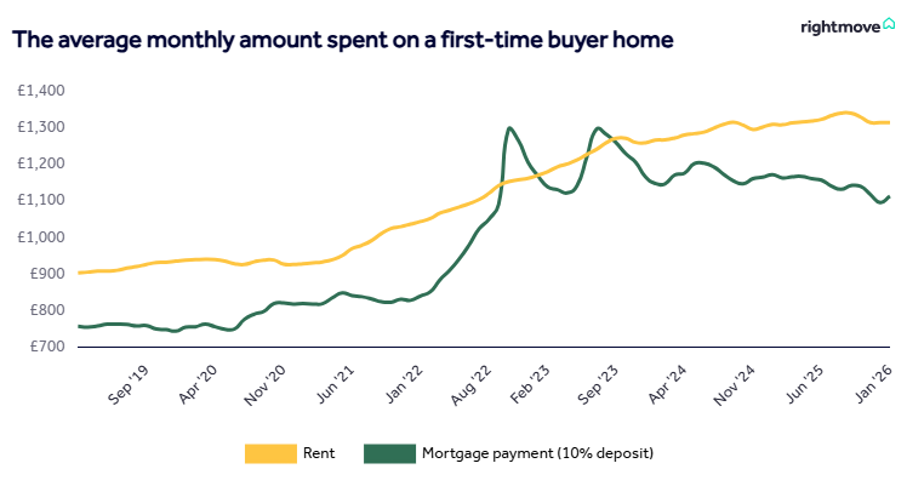

Whereas mortgage charges didn’t fall as far or as quick as some had predicted at the beginning of 2025, a gradual and regular drop in rates of interest allowed for a extra secure and constant market final yr.

Some headline-grabbing price cuts from main lenders on the finish of 2025 and starting of 2026 imply that the typical two-year mounted mortgage price is now at its lowest since 2022 (previous to the disruptive mini-Funds).

- The typical two-year mounted mortgage price* in January 2026 is 4.29%, in contrast with 5.03% presently final yr.

- The most affordable out there two-year mortgage price* for these with a bigger deposit is 3.47%.

To place that into context, thiscould save over £100 a month on their mortgage in comparison with final yr. However bear in mind, precise financial savings will rely upon particular person circumstances, mortgage time period, product availability and lender standards.

What do the specialists assume?

Colleen Babcock, property skilled at Rightmove:

“It’s early days however there are encouraging indicators that extra home-movers are actually planning a 2026 transfer as we head in the direction of the vital Spring shopping for and promoting season. A report variety of visits to Rightmove on Boxing Day and an enormous bounce in exercise following a quieter festive interval have set the tone for a optimistic begin to the yr. Many patrons have seen their affordability enhance with common wage rises outstripping common property costs.”

Matt Smith, Rightmove’s mortgage skilled:

“Mortgage charges have slowly however absolutely been coming down, to the extent that the typical price a typical home-buyer is more likely to see is now the bottom since earlier than the disruptive 2022 mini-Funds. Nonetheless, the monetary markets are at the moment anticipating no extra price cuts till the second quarter of the yr, with the Financial institution of England Base Fee more likely to be held in the course of the subsequent price determination in February. Mortgage charges are subsequently more likely to be regular for the subsequent few months, with solely minor adjustments up or down. Those that have been ready for cheaper mortgage charges earlier than performing may at the moment be seeing a few of the finest offers that might be round for some time.”

Rightmove isn’t authorised to provide monetary recommendation; the data and opinions offered in these articles will not be meant to be monetary recommendation and shouldn’t be relied upon when making monetary selections. Please search recommendation from a regulated mortgage adviser.

Month-to-month adjustments in common property asking costs (12 months ending January 2026)

Map exhibiting month-to-month and annual regional property worth adjustments (January 2026)

Month-to-month common spend on hire and mortgage funds (properties with a ten% deposit, since September 2019)

Wanting forward

The market is off to a busy begin in 2026, with many new properties coming to market being nicely positioned to reap the benefits of the current uptick in purchaser demand. The current flurry of exercise means that patrons and sellers alike are eager to push on in early 2026 and safe their subsequent steps now, fairly than ready for the spring market, with bettering affordability by means of mortgage price cuts driving this course of.

Whereas it stays to be seen whether or not this sturdy begin to the yr will carry by means of to the height promoting season of Spring, the market stays lively, and sensibly priced properties will probably appeal to excessive ranges of consideration.

Information supply: Rightmove Home Value Index, January 2026

*Mortgage price knowledge is offered by Podium and is a median based mostly on 95% of the mortgage market. All charges are based mostly on merchandise with a circa £999 payment.

[ad_2]